An All-in-One ETF Combining the 3 Top Investments for Inflation

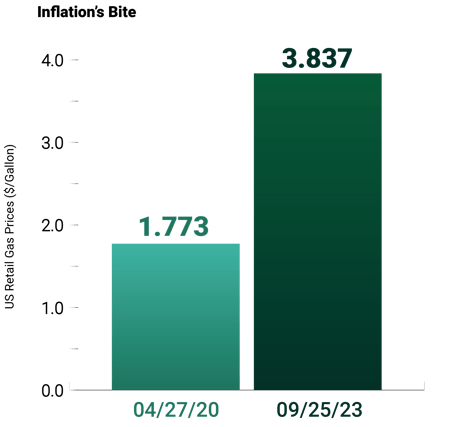

Today we face a challenge that lay dormant for years. Inflation rose rapidly in 2021 driven by pandemic disruption and has wreaked havoc on consumer prices ever since. Just look at the gas pump. The price of a gallon of gas has more than doubled in recent years.

Source: US Energy Information Administration

Investors Beware: Inflation Can Halve Your Purchasing Power

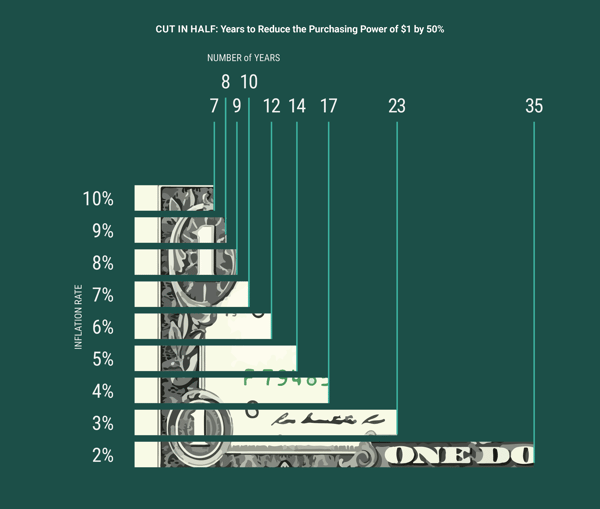

Investors feel the pinch, too, though differently. Inflation can erode the value of wealth created by years of diligent savings and investing. A 3% inflation rate cuts your purchasing power in half in 23 years, with massive implications for your college and retirement savings accounts. Higher inflation rates erode purchasing power even faster.

Even if monthly inflation measures, like headline or core CPI (Consumer Price Index), recede from recent highs, the inflation threat remains. Indeed, a smooth, straight and swift descent back to the Fed’s 2% inflation target is unlikely. An aging population, labor and housing shortages, and disrupted global supply chains suggest persistent, structural inflation is here to stay. What can investors do about it?

Why Investors Need an “All-in-One” Inflation Strategy

Inflation is complex, and no single investment on its own has proven to effectively combat its effects throughout an entire inflation cycle. Inflation-sensitive investments may be effective at varied times (or exhibit risk) depending on underlying inflation drivers and cycles. We believe investors should deploy multiple solutions to hedge inflation’s impact.

PPI: AXS Astoria Inflation Sensitive ETF

This is where the AXS Astoria Inflation Sensitive ETF (ticker: PPI) can make a difference. PPI distinguishes itself from single-asset solutions by adopting a flexible, multi-asset allocation approach. The strategy thoughtfully combines a mix of inflation-sensitive stocks, commodities and TIPS, aiming to both mitigate inflation’s effect and seek gains in areas that may do well when prices are elevated. This all-in-one portfolio offers a multi-asset allocation strategy designed to dynamically navigate the complexities of inflation while striving for long-term portfolio growth.

3 Leading Investments for Inflation

The PPI ETF combines three time-tested inflation-hedging assets: Inflation-Sensitive Stocks, Commodities and Treasury Inflation-Protected Securities (TIPS)

What follows is a quick rundown of each. For more color, see our eBook 5 Ways to Fight Inflation with ETFs.

1. Inflation-Sensitive Stocks

PPI targets the equities of companies that demonstrate resilience in inflationary environments. Sectors represented in the fund may include, among others:

Companies in these arenas often possess pricing power, which allows them to adjust product prices in response to rising costs.

2. Commodities

Commodities have historically shown strong correlation with inflation, making them an essential part of PPI’s multi-asset approach. In fact, the rising prices of commodities often have an outsized impact on overall inflation levels – think of our gas price example. Physical commodities like gold, energy and agricultural products have the potential to appreciate in value during inflationary periods. By including commodities ETFs as a part of its portfolio, PPI aims to provide an additional layer of protection against inflation.

3. TIPS

Treasury Inflation-Protected Securities can also be an inflation-hedging component of PPI's strategy. TIPS are designed to provide investors with protection against inflation by adjusting their principal value in response to changes in the CPI. This mechanism ensures that investors’ purchasing power remains relatively stable, even in the face of rising inflation. PPI may focus on low-duration TIPS, which may provide inflation sensitivity with less interest rate and duration risk.

Active Management Matters

Because the inflationary environment is in constant flux, investing cannot be a set-it-and-forget-it exercise. We believe no simple approach or index exists that can adequately respond across an inflation cycle. That’s why an effective inflation-sensitive portfolio must be continually monitored and actively managed.

Astoria Portfolio Advisors, New York City-based specialists in ETF investing, serve as the portfolio manager for PPI. Astoria adjusts PPI's asset mix and securities holdings based on their outlook for optimal outcomes and lower risks.

Why Go Multi?

Much like a multivitamin can improve one’s health, a diversified portfolio can improve long-term results. The multi-asset allocation strategy of the AXS Astoria Inflation Sensitive ETF takes diversification a step further by blending distinct investment types that have historically demonstrated resilience in inflationary environments. PPI’s approach seeks to reduce the overall risk of investor portfolios while enhancing the potential for long-term growth.

Speak to an Expert

Are you a financial professional exploring inflation-sensitive investments for your clients? Contact us to schedule a convenient time.

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

IMPORTANT RISK DISCLOSURE

ETFs involve risk including possible loss of principal. There is no assurance that the Fund will achieve its investment objective.

There is no guarantee the sectors or asset classes the advisor identifies will benefit from inflation. Fund may invest a larger portion of its assets in one or more sectors than many other funds, and thus will be more susceptible to negative events affecting those sectors.

Equity Securities Risk: Equity securities may be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase. Equity securities may decline significantly in price over short or extended periods of time, and such declines may occur in the equity market as a whole, or in only a particular country, company, industry or sector of the market.

Commodities Risk: Commodity prices can have significant volatility, and exposure to commodities can cause the value of the Fund’s shares to decline or fluctuate in a rapid and unpredictable manner. The values of commodities may be affected by changes in overall market movements, real or perceived inflationary trends, commodity index volatility, changes in interest rates or currency exchange rates, population growth and changing demographics, international economic, political and regulatory developments, and factors affecting a particular region, industry or commodity.

Futures Contracts Risk: The Fund expects that certain of the Underlying ETFs in which it invests will utilize futures contracts for its commodities investments. The risk of a position in a futures contract may be very large compared to the relatively low level of margin the underlying ETF is required to deposit. In many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the size of a required margin deposit. The prices of futures contracts may not correlate perfectly with movements in the securities or index underlying them.

TIPS Risk: Principal payments for Treasury Inflation-Protection Securities are adjusted according to changes in the Consumer Price Index (CPI). While this may provide a hedge against inflation, the returns may be relatively lower than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of the Fund's exposure to U.S. Treasury obligations to decline.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. Brokerage commissions will reduce returns. NAVs are calculated using prices as of 4:00 PM Eastern Time. The closing price is the midpoint between the bid and ask price as of the close of exchange. Closing price returns do not represent the returns you would receive if you traded shares at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of AXS Astoria Inflation Sensitive ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by visiting www.axsinvestments.com. The Prospectus should be read carefully before investing.

Distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments. AXI000383

Author: John Davi

Portfolio Manager, AXS Astoria Inflation Sensitive ETF (PPI) Mr. Davi is the CEO, CIO and Founder of Astoria Portfolio Advisors, a leading investment management firm and ETF Strategist, specializing in research driven, multi-asset ETF and thematic equity portfolio construction. He is an award-winning research strategist and has over 20 years of experience as an ETF industry leader and innovator.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

By the time inflation reemerged from a three-decade hibernation, Astoria Portfolio Advisors and CEO ...

Inflation has been a top financial headline for a while due to its pervasive impact on consumers, bu...

Persistent, long-term inflation can cut the purchasing power of investor savings in half.