3 Major Causes of Inflation and How to Invest for Each

Inflation has been a top financial headline for a while due to its pervasive impact on consumers, businesses, money management, the economy and public policy. But what exactly causes inflation? And how do these factors affect your investing?

The answers aren’t simple, but let’s break it down.

Inflation Drivers

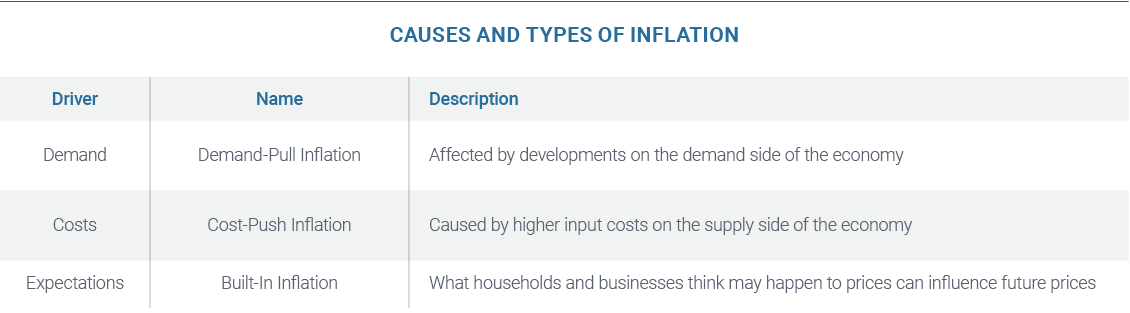

Economists generally identify three principal drivers of inflation:

- Aggregate demand

- Cost structures

- Built-in inflation expectations

Investors must consider all three when analyzing and forecasting inflation to adjust their portfolios. The causes and types of inflation are summarized in the table below:

Let's explore these to gain a better understanding:

1. Demand-Pull Inflation: Excess Demand

What is it?

Demand-pull inflation occurs when there's a surge in demand for goods and services that outpaces supply. When more people want something, but there isn’t enough of it to go around, prices typically rise. In economic terms, aggregate demand for goods and services surpasses aggregate supply. This disequilibrium leads to upward pressure on prices.

How does it work?

Imagine a hot new tech product. If everyone wants to buy it and the manufacturer can't keep up with the demand, the price will likely increase. On a larger scale, if consumers, government and businesses all increase spending simultaneously, and total demand outpaces supply, the result is demand-pull inflation.

Factors contributing to demand-pull inflation:

- Monetary policies and lower interest rates lead to increased borrowing and spending by households and businesses

- Government policies and fiscal expansion lead to bigger budgets, deficits and increased spending

- Increased consumer confidence due to economic stability or prosperity leads to higher prices

2. Cost-Push Inflation: Supply-Side Pressures

What is it?

Cost-push inflation is the result of rising production costs, leading to an increased cost of goods or services without a rise in demand. In economic terms, the escalation in production costs compels firms to pass on increased costs in the form of higher prices, irrespective of demand dynamics.

How does it work?

Think of a simple example: your local restaurant. If the cost of food and rent increase, but the demand for tables remains the same, the restaurant might raise its prices to maintain its profit margins. This is cost-push inflation on a micro scale.

On a macro scale, envision a scenario where global oil prices soar due to geopolitical tensions. Industries reliant on oil as an input witness inflated production costs. Unless absorbed by firms, these costs are transmitted to consumers as elevated prices, resulting in cost-push inflation.

Factors contributing to cost-push inflation:

- Supply chain disruptions impeding the availability of materials

- Increases in wages due to labor market dynamics

- Exogenous shocks, such as natural calamities or geopolitical events affecting production

3. Inflation Expectations: The Self-Fulfilling Prophecy

What is it?

Inflation expectations are about human belief and behavior. Essentially, if businesses, households and workers all expect prices and wages to rise in the future, their actions may actually cause inflation to occur. Economists call this "built-in inflation."

How does it work?

Let's say a business believes that prices for their goods will rise in the future. Anticipating this, they might increase wages for their employees to keep them at the company. With more money in hand, employees might start spending more, leading to an increase in demand and, consequently, an increase in prices.

Factors contributing to inflation expectations:

- Past experience with inflation

- Media reports, “expert” predictions and inflationary sentiment

- Pronouncements and strategic guidance from central banks

Investment Considerations

Each type of inflation has varied impacts across asset types. Understanding these impacts can help you guide portfolio positioning.

1. Cost-Push Inflation: Winners and Losers

This form of inflation is characterized by upward pressure on prices due to increased production costs and supply chain disruptions.

Which investments potentially benefit?

In such an environment, commodities, particularly those closely tied to essential industrial inputs such as oil or precious metals, may perform well. Their intrinsic value tends to rise in tandem with escalating production expenses. Stocks of companies involved in commodity production may also benefit, such as energy, materials and industrial stocks.

Which investments suffer?

Conversely, companies heavily reliant on these inputs may experience margin compression, potentially affecting equity performance. Furthermore, cost-push inflation can compel central banks to tighten monetary policy, resulting in higher interest rates that negatively influence bond prices.

Mixed results

Floating rate securities provide higher yields as interest rates rise. Floating rate credit, however, is at risk of downgrades and defaults if sustained higher rates impact corporate profitability.

2. Demand-Pull Inflation: Winners and Losers

This type of inflation arises from excessive consumer demand relative to available goods and services, akin to a bidding war.

Which investments benefit?

Equities have generally thrived in such circumstances as companies can increase prices and expand profit margins. Real estate also has tended to benefit, as heightened purchasing power encourages property investments.

Which investments suffer?

Once again, fixed income securities face headwinds, as the increased demand for goods and services can prompt central banks to raise interest rates to curb inflation. This upward rate trajectory can erode the value of existing bonds.

Mixed results

Once again, floating rate securities may benefit and provide higher yields as interest rates rise. Floating rate credit, however, is at risk of downgrades and defaults if higher rates impact corporate profitability – unless increased demand and prices help improve a company’s prospects.

3. Built-In Expectation-Driven Inflation: Winners and Losers

Built-in, or wage-price, inflation occurs when expectations of future price increases drive workers to demand higher wages, thereby increasing production costs.

Which investments benefit?

Initially, this can lead to profit gains for corporations as they pass these costs onto consumers. Consequently, equities may exhibit strength during the early stages. Commodities may benefit from sustained price increases.

Which investments suffer?

If inflationary expectations become entrenched, an inflationary spiral can follow. This is a precarious scenario for stocks, as uncertainty and volatility may erode investor confidence. Higher inflation can also drive down stock valuations. Bonds, in particular, may face challenges in such an environment, given the erosion of the real value of future coupon payments as inflation escalates.

Conclusion

For investment advisors, understanding the root causes of inflation is crucial. It's not just about recognizing current economic conditions, but formulating forward-looking investment strategies and guiding clients

Understanding the interplay between distinct types of inflation and investing is pivotal for successfully navigating the complex landscape of inflation-driven investment strategies.

Hedging Inflation

Sophisticated investors and their advisors have a nuanced understanding of inflation and seek inflation-sensitive investments to enhance their portfolios.

AXS Investments

AXS Investments is a leading alternative investment manager providing a diversified family of alternative investments for growth, income and diversification. The firm empowers investors to diversify their portfolios with investments previously available only to the largest institutional and high net worth investors. The investor-friendly AXS funds are time-tested, liquid, transparent and managed by high pedigreed portfolio managers with long and strong track records. For more information, visit www.axsinvestments.com.

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

ETFs involve risk including possible loss of principal. Diversification is a strategy designed to manage risk. It cannot ensure a profit or protect against loss in a declining market.

Equity Securities Risk: Equity securities may be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase. Equity securities may decline significantly in price over short or extended periods of time, and such declines may occur in the equity market as a whole, or in only a particular country, company, industry or sector of the market.

Commodities Risk: Commodity prices can have significant volatility, and exposure to commodities can cause the value of an investment to decline or fluctuate in a rapid and unpredictable manner. The values of commodities may be affected by changes in overall market movements, real or perceived inflationary trends, commodity index volatility, changes in interest rates or currency exchange rates, population growth and changing demographics, international economic, political and regulatory developments, and factors affecting a particular region, industry or commodity. ETFs may utilize futures contracts for commodities investments. The risk of a position in a futures contract may be very large compared to the relatively low level of margin the underlying ETF is required to deposit. In many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the size of a required margin deposit. The prices of futures contracts may not correlate perfectly with movements in the securities or index underlying them.

Gold and Precious Metals Risks: Precious metal ETF shares trade like stocks, are subject to investment risk and will fluctuate in market value. The value of the shares relates directly to the value of the metals held by the ETF (less its expenses), and fluctuations in the price of the metal could materially and adversely affect an investment in the shares. The price received upon the sale of the shares, which trade at market price, may be more or less than the value of the metal represented by them.

TIPS Risk: Principal payments for Treasury Inflation-Protection Securities are adjusted according to changes in the Consumer Price Index (CPI). While this may provide a hedge against inflation, the returns may be relatively lower than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of the Fund’s exposure to U.S. Treasury obligations to decline.

Distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments. AXI000343

© 2023, AXS Investments

Author: John Davi

Portfolio Manager, AXS Astoria Inflation Sensitive ETF (PPI) Mr. Davi is the CEO, CIO and Founder of Astoria Portfolio Advisors, a leading investment management firm and ETF Strategist, specializing in research driven, multi-asset ETF and thematic equity portfolio construction. He is an award-winning research strategist and has over 20 years of experience as an ETF industry leader and innovator.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

By the time inflation reemerged from a three-decade hibernation, Astoria Portfolio Advisors and CEO ...

Today we face a challenge that lay dormant for years. Inflation rose rapidly in 2021 driven by pande...

Persistent, long-term inflation can cut the purchasing power of investor savings in half.