How Astoria Sought to Turn Inflation Sensitivity Into an Investor Advantage

By the time inflation reemerged from a three-decade hibernation, Astoria Portfolio Advisors and CEO John Davi were already busy. The investment management firm began managing a Separately Managed Account (SMA) for its institutional and RIA clients aimed at not just hedging against inflation but also capitalizing on assets that historically perform well during inflationary periods.

By the end of 2021, AXS Investments and Astoria launched a user-friendly version of the strategy called the AXS Astoria Inflation Sensitive ETF. Its ticker, PPI, was inspired by, but not to be confused with, the Producers Price Index, an important inflation indicator.

In this blog, we will introduce Astoria and the firm’s distinctive take on how to turn the inflation cycle into an advantage when it comes to long-term portfolio planning.

Meet Astoria Portfolio Advisors

Astoria, a respected name in financial circles, provides investment management, research and sub-advisory services. Asset managers and RIAs turn to them for their research-driven, cross-asset, ETF and thematic equity portfolio construction expertise. The firm oversees approximately $1.37 billion in assets under management and advisement as of October 2023.

NYC-based Astoria is led by founder and CEO John Davi. He is an award-winning ETF, macro and derivatives research strategist who frequently appears in major financial media, such as CNBC and Bloomberg, as an authority on ETFs and the markets. Mr. Davi has published hundreds of institutional research reports and is a prolific voice on social media.

John Davi

CEO, Astoria Portfolio Advisors

At Astoria, deep research underpins every investment decision. When formulating its ETF portfolios, Astoria analysts utilize a risk-based, quantitative investment approach. Their strategies are strategically constructed relative to their respective benchmarks and actively managed through factor tilts and the use of alternatives to dampen portfolio volatility and drive excess returns.

When Astoria Set Its Sight on Inflation

Astoria focuses on a variety of investment themes and has particularly high conviction regarding “inflation-sensitive” investments. By the time monthly CPI readings were ticking up rapidly, spurred by late-pandemic supply chain issues, high consumer demand and the Russia-Ukraine war, Astoria had a unique inflation strategy in place for its institutional clients. However, there were only a handful of inflation-centric investment tools available to the public at the time, none of which pursued the multi-asset strategy Astoria espoused.

Don’t Just Hedge Against Inflation, Potentially Benefit from Inflation

Astoria and AXS shared the viewpoint that investors should not only look to hedge their portfolios against inflation, but also to hold exposures to assets that may be able to benefit from elevated price levels. Recognizing the need for a more comprehensive solution, AXS Investments partnered with Astoria to roll out an all-in-one ETF designed for broad adoption. Their collaboration gave birth to the AXS Astoria Inflation Sensitive ETF, offering investors one simple ticker, PPI, to seek to do both.

PPI’s Multi-Asset Approach

Rather than relying on a single asset class or traditional inflation hedges, Astoria's strategy encompasses a multi-faceted approach. This approach seeks to provide investors with a robust portfolio that can adapt to changes throughout the cycle of inflation -- whether inflation is on a tear upwards, peaking at historic high CPI levels, or leveling out. Astoria believes the return to a 2% inflation target will be long and arduous. In other words, we expect to have to deal with persistent inflation for a sustained period, a reality for which all investors’ portfolios should seek to be fortified.

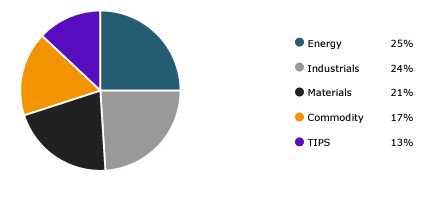

For PPI, Astoria actively manages a fluid combination of inflation-sensitive stocks, commodities and TIPS, aiming to both mitigate inflation’s effect and seek gains in areas that may do well when prices are elevated. For more on this, read our blog, The All-In-One ETF Combining the 3 Top Investments for Inflation.

PPI Multi-Asset Approach

Source: Astoria Portfolio Advisors. Data as of 9/30/2023. Subject to change.

How Investors Put PPI to Work

PPI can make a home in a portfolio to serve multiple purposes. One can treat the fund as an inflation hedge to help blunt the eroding effects of persistent or “spiky” inflation. Another is to see PPI as equity-focused targeting risk-adjusted value. PPI’s sizable stock portfolio has a considerably low 10.73 price-to-earnings ratio compared to 18.79 for the comparatively expensive S&P 500 12/5/2023. Importantly, active management means PPI can seek to pivot into and out of different inflation-sensitive assets as the economy moves through the inflation cycle.

PPI launched on December 29, 2021, and was named 2022 ETF Newcomer of the Year in Annual ETF and Mutual Fund Industry Awards and “ETF of the Year” Finalist in 2023 ETF.com Awards.

It’s Never Too Late

Complacency can set in when elevated prices and inflation persist for some time. Unfortunately, some investors may think that the damage is done and that they missed their opportunity to help hedge against inflation. We believe inflation is not likely to retreat soon.

With PPI, Astoria Portfolio Advisors adjusts the PPI portfolio across the inflation cycle as it seeks to benefit from, not just hedge, inflation. Injecting inflation sensitivity into your portfolio makes good sense anytime. For more on PPI, visit the fund web page here.

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

IMPORTANT RISK DISCLOSURE

Investors should carefully consider the investment objectives, risks, charges and expenses of AXS Astoria Inflation Sensitive ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by visiting www.axsinvestments.com. The Prospectus should be read carefully before investing.

ETFs involve risk including possible loss of principal. There is no assurance that the Fund will achieve its investment objective.

There is no guarantee the sectors or asset classes the advisor identifies will benefit from inflation. Fund may invest a larger portion of its assets in one or more sectors than many other funds, and thus will be more susceptible to negative events affecting those sectors.

Equity Securities Risk: Equity securities may be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase. Equity securities may decline significantly in price over short or extended periods of time, and such declines may occur in the equity market as a whole, or in only a particular country, company, industry or sector of the market.

Commodities Risk: Commodity prices can have significant volatility, and exposure to commodities can cause the value of the Fund’s shares to decline or fluctuate in a rapid and unpredictable manner. The values of commodities may be affected by changes in overall market movements, real or perceived inflationary trends, commodity index volatility, changes in interest rates or currency exchange rates, population growth and changing demographics, international economic, political and regulatory developments, and factors affecting a particular region, industry or commodity.

Futures Contracts Risk: The Fund expects that certain of the Underlying ETFs in which it invests will utilize futures contracts for its commodities investments. The risk of a position in a futures contract may be very large compared to the relatively low level of margin the underlying ETF is required to deposit. In many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the size of a required margin deposit. The prices of futures contracts may not correlate perfectly with movements in the securities or index underlying them.

TIPS Risk: Principal payments for Treasury Inflation-Protection Securities are adjusted according to changes in the Consumer Price Index (CPI). While this may provide a hedge against inflation, the returns may be relatively lower than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of the Fund's exposure to U.S. Treasury obligations to decline.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. Brokerage commissions will reduce returns. NAVs are calculated using prices as of 4:00 PM Eastern Time. The closing price is the midpoint between the bid and ask price as of the close of exchange. Closing price returns do not represent the returns you would receive if you traded shares at other times.

Distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments. AXI000389

Author: John Davi

Portfolio Manager, AXS Astoria Inflation Sensitive ETF (PPI) Mr. Davi is the CEO, CIO and Founder of Astoria Portfolio Advisors, a leading investment management firm and ETF Strategist, specializing in research driven, multi-asset ETF and thematic equity portfolio construction. He is an award-winning research strategist and has over 20 years of experience as an ETF industry leader and innovator.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

Today we face a challenge that lay dormant for years. Inflation rose rapidly in 2021 driven by pande...

Inflation has been a top financial headline for a while due to its pervasive impact on consumers, bu...

Persistent, long-term inflation can cut the purchasing power of investor savings in half.

-1.png?width=744&height=222&name=30212%20%20AXS%20Schedule%20a%20Consultation%20Promotional%20Email%20Campaign%20v1%20(5)-1.png)