5 Equity Sectors to Know for Inflation Shocks and Bear Markets

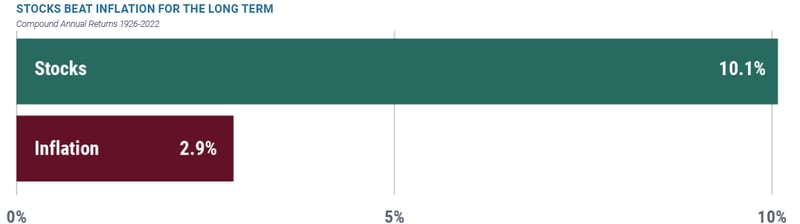

Over the long term, stocks have delivered returns well above the inflation rate. For investors with a long time horizon, stocks can serve as a source of real returns to help overcome the erosion of purchasing power caused by inflation.

Over the short term, however, inflation can be problematic for stock market investors.

Source: Ibbotson SBBI For illustrative purposes only and not indicative of any investment. Large stocks are represented by the Ibbotson Large Company Stock Index. Inflation is represented by the Consumer Price Index. Underlying data is from the Stocks, Bonds, Bills, and Inflation® (SBBI®) Yearbook, by Roger G. Ibbotson and Rex Sinquefield, updated annually. An investment cannot be made directly in an index. Past performance is no guarantee of future results. Data assumes reinvestment of all income and does not account for taxes or transaction costs. The average return represents a compound annual return. Stocks are not guaranteed and have been more volatile than the other asset classes. ©2023 Morningstar, Inc.

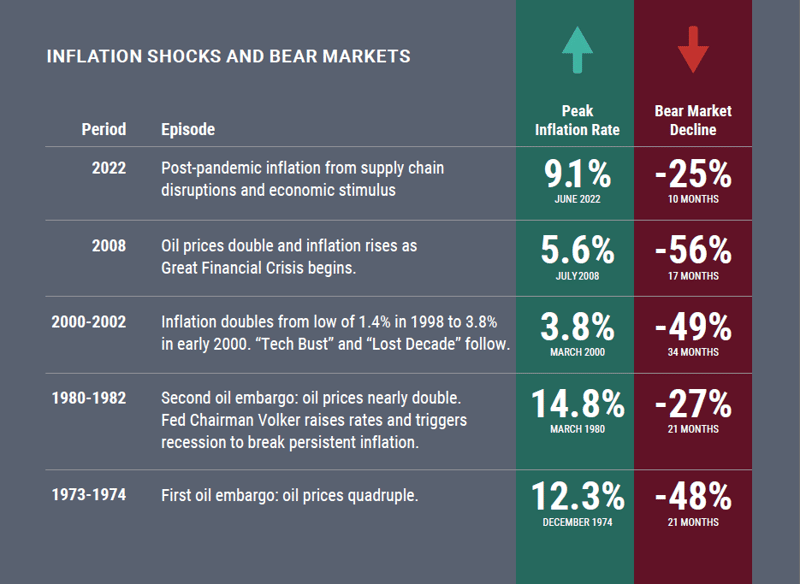

Sudden and unexpected increases in inflation can catch investors, industries and policymakers off guard. “Spikeflation,” another name for short-term inflation shocks, creates uncertainty, financial market volatility and economic dislocation. Catalysts include supply chain disruptions, geopolitical events or other unforeseen factors.

Inflation Up, Markets Down

These sudden increases may also trigger a sharp drop in financial asset values. Investors can prepare their portfolios in advance by including allocations to inflation-sensitive assets and stock market sectors.

Inflation Shocks & Bear Markets

Sources: Inflation.eu Worldwide Inflation Data and Forbes.com. Consumer Price Index (CPI) is used to represent the Peak Inflation Rate. Bear Market Declines are represented by the S&P 500 Index, a market-capitalization-weighted index of 500 leading publicly traded companies in the US. For illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. Past performance is no guarantee of future results.

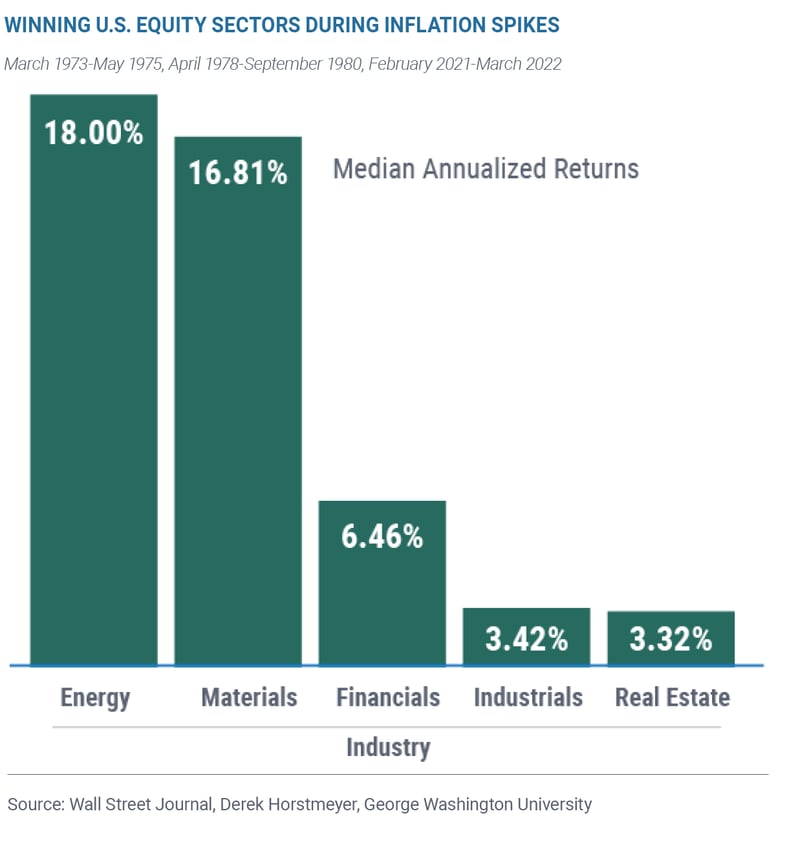

Inflation Fighters: Winning vs. Losing Stock Market Sectors

When inflation spikes, some stock market sectors win while others lose. Consider maintaining an allocation to sectors that have historically outperformed as a hedge against inflation.

Energy has been a top stock market sector for inflation, as rising oil prices are often an inflation driver. The materials sector has also performed well during inflationary episodes, due to its participation in the inflation-sensitive commodities sector. Keep in mind, past performance is no guarantee of future results.

For illustrative purposes only and not indicative of any investment. Past performance is no guarantee of future results. Data based on calculations by Derek Horstmeyer, George Mason University, author of the Wall Street Journal article. Data is based on the returns for all stocks listed on the New York Stock Exchange or Nasdaq over the past 50 years. Three inflation spike periods were determined based on when the consumer price index inflation rate doubled in less than 24 months: March 1973 to May 1975, April 1978 to September 1980, and February 2021 to March 2022. Company data was divided into 10 industries by the author of the article. Sector data reflects the median stock returns in each industry during each of the three periods of surging inflation.

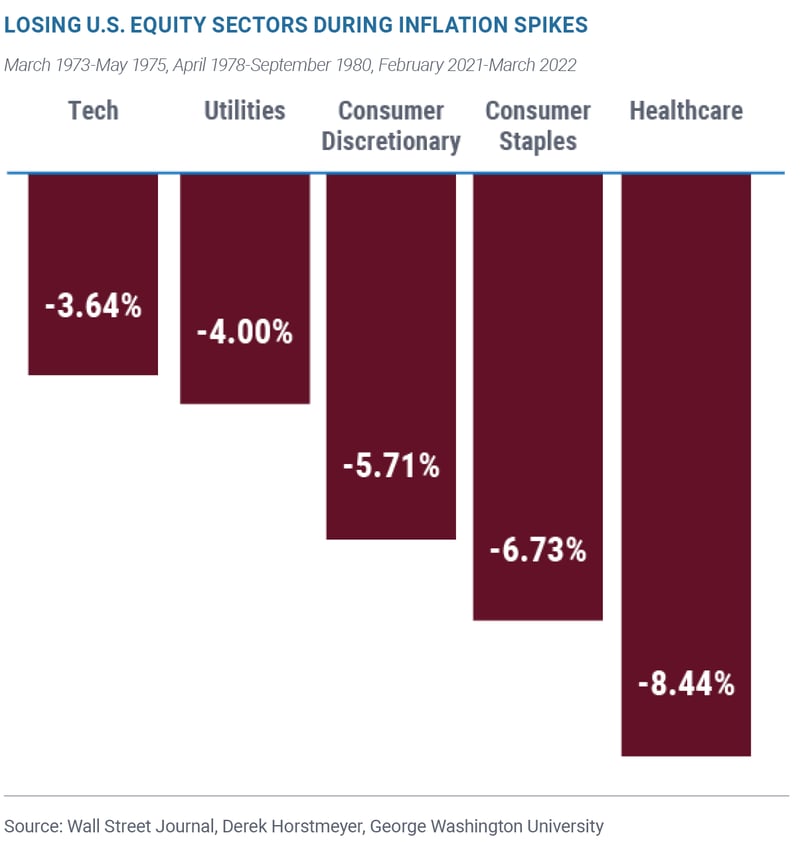

Also, you might consider reducing exposures to sectors that have been historically vulnerable amid inflation spikes, such as healthcare and consumer stocks.

Rising input costs negatively impact healthcare stocks during inflation spikes. Rising prices reduce consumer purchasing power and confidence, a dual headwind for consumer staples and discretionary stocks when inflation becomes elevated. Technology stocks may also suffer, as future projected earnings become less valuable with higher inflation rates.

Source: Derek Horstmeyer, Wall Street Journal

Keep in mind that diversification among sectors is important, as stock market sector performance may be unpredictable. Of course, diversification cannot ensure a profit or protect against loss.

How to Hedge Inflation

Disciplined investors now include inflation as a key consideration in their investment plans. Investors have rediscovered inflation-sensitive investments as a key allocation for their portfolios.

To learn more about our inflation-sensitive ETF visit AXS Astoria Inflation Sensitive ETF (PPI).

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

AXS Investments

AXS Investments is a leading alternative investment manager providing a diversified family of alternative investments for growth, income and diversification. The firm empowers investors to diversify their portfolios with investments previously available only to the largest institutional and high net worth investors. The investor-friendly AXS funds are time-tested, liquid, transparent and managed by high pedigreed portfolio managers with long and strong track records. For more information, visit www.axsinvestments.com.

IMPORTANT RISK DISCLOSURE ABOUT THE AXS INFLATION SENSITIVE ETF (PPI)

ETFs involve risk including possible loss of principal. There is no assurance that the Fund will achieve its investment objective.

There is no guarantee the sectors or asset classes the advisor identifies will benefit from inflation. Fund may invest a larger portion of its assets in one or more sectors than many other funds, and thus will be more susceptible to negative events affecting those sectors.

Equity Securities Risk: Equity securities may be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase. Equity securities may decline significantly in price over short or extended periods of time, and such declines may occur in the equity market as a whole, or in only a particular country, company, industry or sector of the market.

Commodities Risk: Commodity prices can have significant volatility, and exposure to commodities can cause the value of the Fund’s shares to decline or fluctuate in a rapid and unpredictable manner. The values of commodities may be affected by changes in overall market movements, real or perceived inflationary trends, commodity index volatility, changes in interest rates or currency exchange rates, population growth and changing demographics, international economic, political and regulatory developments, and factors affecting a particular region, industry or commodity.

Futures Contracts Risk: The Fund expects that certain of the Underlying ETFs in which it invests will utilize futures contracts for its commodities investments. The risk of a position in a futures contract may be very large compared to the relatively low level of margin the underlying ETF is required to deposit. In many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the size of a required margin deposit. The prices of futures contracts may not correlate perfectly with movements in the securities or index underlying them.

TIPS Risk: Principal payments for Treasury Inflation-Protection Securities are adjusted according to changes in the Consumer Price Index (CPI). While this may provide a hedge against inflation, the returns may be relatively lower than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of the Fund's exposure to U.S. Treasury obligations to decline.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. Brokerage commissions will reduce returns. NAVs are calculated using prices as of 4:00 PM Eastern Time. The closing price is the midpoint between the bid and ask price as of the close of exchange. Closing price returns do not represent the returns you would receive if you traded shares at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of AXS Astoria Inflation Sensitive ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by visiting www.axsinvestments.com. The Prospectus should be read carefully before investing.

Distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments. AXI000339

© 2023, AXS Investments

Author: John Davi

Portfolio Manager, AXS Astoria Inflation Sensitive ETF (PPI) Mr. Davi is the CEO, CIO and Founder of Astoria Portfolio Advisors, a leading investment management firm and ETF Strategist, specializing in research driven, multi-asset ETF and thematic equity portfolio construction. He is an award-winning research strategist and has over 20 years of experience as an ETF industry leader and innovator.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

By the time inflation reemerged from a three-decade hibernation, Astoria Portfolio Advisors and CEO ...

Today we face a challenge that lay dormant for years. Inflation rose rapidly in 2021 driven by pande...

Inflation has been a top financial headline for a while due to its pervasive impact on consumers, bu...