Busting the Barriers to VC Return Exposure

| The AXS FTSE Venture Capital Return Tracker Fund does not invest in venture capital funds or start-up companies, and an investment in the Fund will not give investors access or exposure to venture capital, start-up companies, or imply a similar investment experience as described in the blog below. |

Busting the Barriers to VC Exposure

In our first blog of this Venture Capital series, we posed the question: Why is it that exposure to Venture Capital is nowhere to be found in most people’s investment portfolios?

We are going to delve into the barriers and explain a clever way to circumvent them.

The "Keep Out" Signs for Non-Institutional Investors

Despite the potential return opportunity, successfully investing in Venture Capital is difficult and out of reach for many investors due to unique industry dynamics, including:

- Illiquidity: Venture Capital Funds typically have 10-15 year lifespans, well beyond the tolerance of most investors.

- Access: Investment minimums can be prohibitively high, often starting at greater than $1M particularly for later stage funds. Also, getting into top funds is extremely difficult.

- Opacity: Information flow is constrained for regulatory and competitive reasons, making traditional due diligence materially more difficult.

- The Power Law: The vast majority of venture capital investments (up to 90%) fail to generate a positive return and many fail altogether. The industry is dependent upon a small number of investments (around 10%) to generate returns that are many times greater than the average of the industry.

- Dispersion of Manager Returns: As a byproduct of the Power Law, Venture Capital tends to have the highest dispersion of manager returns among all equity classes. Put simply, winners win big and losers lose big. Investing with the right manager and fund disproportionately drives success in Venture Capital.

Challenges and Opportunities

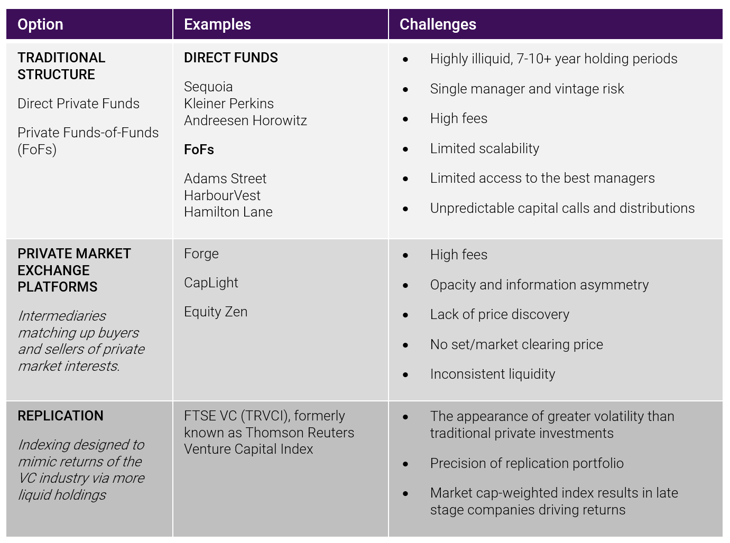

For investors pursuing Venture Capital investments, the options largely fall into three categories: Traditional Structures, Private Market Platforms and Replication.

Each of these approaches to VC investing leads to different benefits and challenges. Decisions will ultimately be driven by the set of tradeoffs each investor is willing to make.

How the Heck Do You Value VC?

Another roadblock for regular investors is that, unlike with public companies, they have no idea how to place a value on private companies.

Valuing VC-backed companies and their related funds can be tricky, often requiring an approach that is equal parts art (subjective elements) and science (objective elements). All unlisted investments lack valuation clarity and the active price discovery associated with exchange-traded securities. As a consequence, these private companies require substantially more work to accurately value.

In general, the value of a VC-backed company is determined by the post-money valuation of the most recent funding round. While this process provides a clear valuation, having confidence in the “fair market value” of a company at any point subsequent to that period becomes increasingly difficult as more time passes since the last valuation event.

Further, significant changes in market conditions, such as we saw in the market pull-back of 2022, can lead to many companies being materially overvalued based upon the static and stale pricing of their last post-money valuation. At such times, there can appear to be a material dislocation between private and public market valuations.

The BIG Reveal: VC Exposure is Within Reach

Being a true Venture Capitalist is a game for professional VC investors and the ultra-wealthy. Does that mean typical “mom and pop” investors cannot participate? Not necessarily.

Indeed it’s cost-prohibitive and highly risky to own a stake in a start-up company. However, if your end game is simply to get exposure to the performance potential of the Venture Capital universe, rather than to a particular company, there is an investment opportunity designed for that purpose.

Introducing the AXS FTSE Venture Capital Return Tracker Fund (LDVIX)

Since 2014, investors have enjoyed the accessibility of a mutual fund that seeks to provide investment results that correspond generally to the price performance of the FTSE VC Index (TRVCI). The index comprises 150 publicly listed securities selected to replicate the risk/return profile of the VC industry using extensive FTSE data on funding rounds for VC-backed companies.

AXS Investments manages the AXS FTSE Venture Capital Return Tracker Index (ticker LDVIX). Unlike traditional VC funds restricted to institutional and ultra-wealthy investors, LDVIX is a mutual fund with low minimums and lower fees. Because it is priced daily, the fund has full liquidity and is accessible to individual investors, whether accredited or not.

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

IMPORTANT RISK DISCLOSURE

Mutual funds involve risk including possible loss of principal. There is no assurance that the Fund will achieve its investment objective. Diversification does not ensure profits or prevent losses.

Mutual funds involve risks including the possible loss of principal. The Fund may invest in ETFs, ETNs and mutual funds, which are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. ETFs, ETNs and mutual funds are subject to issuer, fixed income and risks specific to the Fund. Venture capital investments involve a greater degree of risk; as a result, the Fund’s returns may experience greater volatility than the overall market. The Fund does not invest in venture capital funds nor does it invest directly in the company funded by venture capital funds. The Fund seeks to generate returns that mimic the aggregate returns of U.S. venture capital backed companies as measured by the FTSE Venture Capital Index (TRVCI). There is a risk that Funds’ return many not match or achieve a higher degree of correlation with the return of the TRVCI. Additionally, the TRVCI’s return may not match or achieve a high degree of correlation with the return of the U.S. venture capital-based companies.

Investments in equity securities are subject to overall market risks. To the extent that the Fund’s investments are concentrated in or significantly exposed to a particular sector, the Fund will be susceptible to loss due to adverse occurrences affecting that sector. Loss may result from the Fund’s investments in derivatives. These instruments may be illiquid, difficult to value and leveraged so that small changes may produce disproportionate losses to the Fund. Over the counter derivatives, such as swaps, are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. In certain circumstances, it may be difficult for the Fund to purchase and sell particular derivative investments within a reasonable time at a fair price.

The AXS FTSE Venture Capital Return Tracker Fund (LDVIX) (the “Fund”) has been developed solely by AXS Investments LLC. The Fund is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies.

All rights in the FTSE Venture Capital Index (the “Index”) vest in the relevant LSE Group company which owns the Index. “FTSE®” “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®” and “The Yield Book®” are trademarks of the relevant LSE Group company and are used by any other LSE Group company under license.

The Index is calculated by or on behalf of London Stock Exchange Group plc or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the Fund. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the Fund or the suitability of the Index for the purpose to which it is being put AXS Investments LLC.

Distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments. AXI000442

Author: AXS Investments

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

The AXS FTSE Venture Capital Return Tracker Fund does not invest in venture capital funds or start-u...

If entrepreneurs are the rock stars of the business world, venture capitalists are the promoters who...