Venture Capital for All Investors

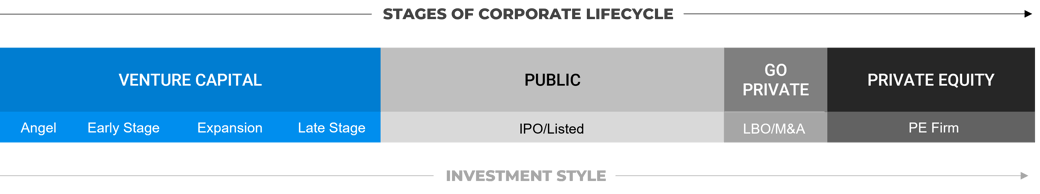

If entrepreneurs are the rock stars of the business world, venture capitalists are the promoters whose funding gets them onto the big stage. Huge brands we all know – from Apple to Zoom – would not have gone public without venture capital fueling their growth. Investors who get in on the early stages of the corporate lifecycle may stand to multiply their investments handsomely.

Locked out of the blue zone?

Most of us have unfortunately been locked out of opportunities to invest in the thousands of entrepreneurial companies with the potential for hugely outsized gains from their sales or IPOs. That leaves individual investors having to concentrate almost entirely on publicly traded stocks, missing out of the front end of the lifecycle — companies backed by venture capital.

GOOD NEWS: While you may never have the means to become a venture capitalist, there’s a way to access to this high reward potential. Read on to find out how. (Hint: it's called LDVIX.)

Who invests in Venture Capital?

Typically, three parties participate in a venture capital (VC) deal.

- Institutional investors, like college endowments, charitable organizations, governments, etc. who manage money for long-term growth.

- High net worth individuals or family offices. They are accredited investors with sizable income and wealth, high risk tolerance and the ability to withstand long lock-up periods of their funds. They are also permitted to trade in illiquid securities.

Venture capital funds pool investor money in one fund to seek private equity stakes in companies. Venture capitalists pick the companies for the portfolio. Using a combination of analytical, business management and other relevant skills, they find and nurture high growth opportunities. These are some of the smartest, forward-thinking people with a knack for spotting future trends and successful businesses. They understand the high risks involved and aim to diversify their investments to mitigate risks. Think Shark Tank.

Private companies receive funding and guidance from the VC fund. These are start-ups and small- to medium-sized enterprises with strong growth potential that need cash to implement their business plan.

If the company successfully grows, it can eventually go public or attract a buyer. The VC fund then gets it share of the proceeds, takes its fees from the transaction, and returns the rest to the limited partners. Returns range from zilch to multiples of the original investment.

Other paths exist to own equity in a private company. Before seeking VC money, start-ups often get an initial injection of cash from individual “angel” investors and may go through rounds of seed capital raised from other sources.

What barriers shut individuals out of Venture Capital?

Historically, the traditional VC investing model only invites an exclusive club of investors. Consider the membership requirements.

| Who's eligible? | Institutional and accredited investors only. |

| What's the minimum investment? | Starts around $1,000,000 and is often much higher. |

| How long is the investment? | 7-10 year lock-up period. |

| What does it cost? | Typically there is a 2% management fee year over year, plus 20% of the capital gains go to the venture capital fund managers. |

The average investor has had no access to VC funds for good reasons. Venture capital carries huge risks and investors must be able to withstand heavy losses. When young companies fail, entire multi-year investments can evaporate in a flash.

As former Shark Tank star Chris Sacca warns “Early-stage companies rarely succeed… don't invest money that you can't afford to lose.” Markets Insider

VC fund portfolios bet on relatively few companies, lacking the diversification you might find in a mutual fund or ETF. Also, no two VC managers will experience the same results, and there is no guarantee that past success will repeat itself.

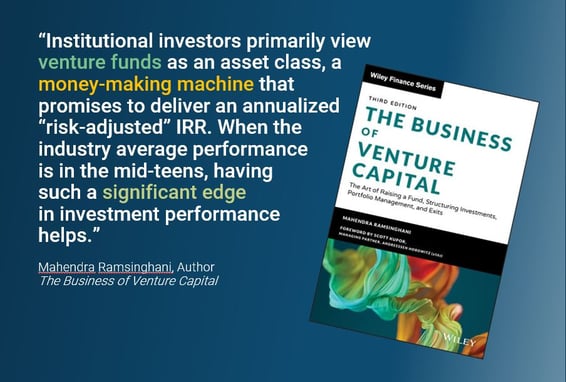

Why do institutional investors love Venture Capital?

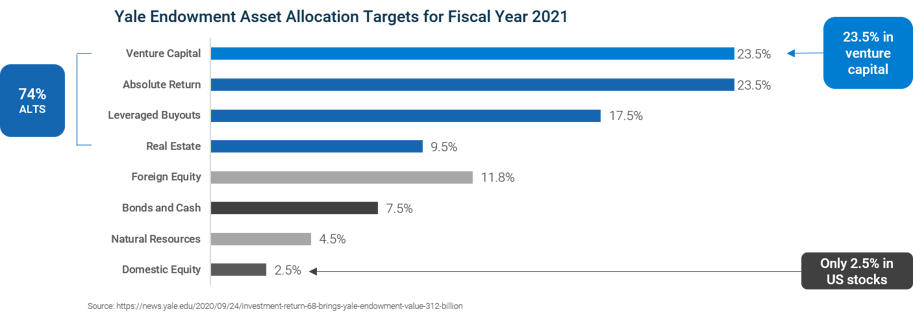

It’s remarkable to compare the differences between the portfolios of institutional and individual investors. Take the Yale Endowment, long revered as the gold standard for smart investing. Observe Yale’s 2021 allocation of nearly a quarter of its assets to venture capital and only 2.5% in U.S. equities.

The Yale Endowment turned the traditional formula of 60% stocks and 40% fixed income on its head, devoting nearly 3/4th of its allocation to alternative investment strategies in pursuit of growth and income independent of the broad markets.

How do you measure Venture Capital’s performance?

Unlike public companies, private businesses do not disclose their financials and don’t have tickers that quantify their daily value. Even so, benchmarks for the venture capital universe do exist.

Remember these letters: T-R-V-C-I. The industry’s first-ever investable venture capital index.

(And this ticker: L-D-V-I-X.)

This lack of information was solved by tapping into a vast research database of financial information from VC-backed companies. The London Stock Exchange Group (LSEG) aggregates this otherwise hard-to-find data from upwards of 9,000 VC-backed companies to calculate the overall valuations and sector breakdown of these private firms. Too bad there is no way to directly invest in the companies in this exclusive database – after all, they are private companies, and no one will invite you to the equity table.

Here’s the ingenious solution. The industry’s first-ever investable VC return tracking index was developed by employing time-tested academic and empirical research to replicate the overall performance of the VC universe through a portfolio of publicly traded stocks. The key is holding stocks that correspond to the sector breakdowns mentioned earlier. If you want to geek out, read about the methodology.

The FTSE Venture Capital Index (TRVCI) (formerly the Thomson Reuters Venture Capital Index) was launched in 2012 and has become one of the leading indicators of the performance of the broad U.S. venture capital industry. Not just the performance (or lack thereof) of one particular company, but rather the performance of the collective venture capital industry at large.

Actually, investors can access Venture Capital exposure!

The high financial commitment (time, money and fees) and the risks that keep non-accredited investors out of direct venture capital deals aren’t going away any time soon. But if you think about why we all invest – to grow and secure wealth for retirement and other future needs – what ultimately matters is risk-adjusted performance, not the exact way you invest. Do you need to pour money directly into pre-IPO companies to achieve their return profile?

“It’s hard for mutual funds to directly own venture capital or private equity in any size, but it can be done through fund replication, which mimics the aggregate returns of the alternatives.”

Barron’s, Making the Case for Liquid Alts 2.0, April 2021

The advent of the Thomson Reuters Venture Capital Index opened a door for individuals to seek to replicate the historically outsized performance generated by venture capital as an asset class.

Only one FUND exists today that tracks the TRVCI index.

- No eligibility restrictions

- No high minimums

- No high fees

- No lock-up periods

- No single manager or single company risk

Description of Indices

NASDAQ Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S.

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

IMPORTANT RISK DISCLOSURE

Mutual funds involve risk including possible loss of principal. There is no assurance that the Fund will achieve its investment objective. Diversification does not ensure profits or prevent losses.

Mutual funds involve risks including the possible loss of principal. The Fund may invest in ETFs, ETNs and mutual funds, which are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. ETFs, ETNs and mutual funds are subject to issuer, fixed income and risks specific to the Fund. Venture capital investments involve a greater degree of risk; as a result, the Fund’s returns may experience greater volatility than the overall market. The Fund does not invest in venture capital funds nor does it invest directly in the company funded by venture capital funds. The Fund seeks to generate returns that mimic the aggregate returns of U.S. venture capital backed companies as measured by the FTSE Venture Capital Index (TRVCI). There is a risk that Funds’ return many not match or achieve a higher degree of correlation with the return of the TRVCI. Additionally, the TRVCI’s return may not match or achieve a high degree of correlation with the return of the U.S. venture capital-based companies.

Investments in equity securities are subject to overall market risks. To the extent that the Fund’s investments are concentrated in or significantly exposed to a particular sector, the Fund will be susceptible to loss due to adverse occurrences affecting that sector. Loss may result from the Fund’s investments in derivatives. These instruments may be illiquid, difficult to value and leveraged so that small changes may produce disproportionate losses to the Fund. Over the counter derivatives, such as swaps, are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. In certain circumstances, it may be difficult for the Fund to purchase and sell particular derivative investments within a reasonable time at a fair price.

The AXS FTSE Venture Capital Return Tracker Fund (LDVIX) (the “Fund”) has been developed solely by AXS Investments LLC. The Fund is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies.

All rights in the FTSE Venture Capital Index (the “Index”) vest in the relevant LSE Group company which owns the Index. “FTSE®” “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®” and “The Yield Book®” are trademarks of the relevant LSE Group company and are used by any other LSE Group company under license.

The Index is calculated by or on behalf of London Stock Exchange Group plc or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the Fund. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the Fund or the suitability of the Index for the purpose to which it is being put AXS Investments LLC.

Author: AXS Investments

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

The AXS FTSE Venture Capital Return Tracker Fund does not invest in venture capital funds or start-u...

The AXS FTSE Venture Capital Return Tracker Fund does not invest in venture capital funds or start-u...