A Fresh Look at Venture Capital

| The AXS FTSE Venture Capital Return Tracker Fund does not invest in venture capital funds or start-up companies, and an investment in the Fund will not give investors access or exposure to venture capital, start-up companies, or imply a similar investment experience as described in the blog below. |

A Fresh Look at Venture Capital

By its nature the world of Venture Capital keeps to itself. Barriers shutter all but the intrepid, deep pocketed few out of its potentially lucrative opportunities. Yet this form of funding younger companies plays such a vital role in spawning innovation and ushering new start-ups through the stages en route to a possible IPO[1].

So, why is it that exposure to Venture Capital (“VC” for short) is nowhere to be found in most people’s investment portfolios? Before exploring that topic, let’s lay the groundwork. This blog reviews the basics of VC, which is a subset of Private Equity, including the stages of funding and growth experienced by VC-backed companies.

[1] Please note that the AXS FTSE Venture Capital Return Tracker Fund does not invest in IPOs.

The Roots of Venture Capital

While Venture Capital is typically associated with California-based technology start-up companies, French-born George Doriot is generally regarded as the “father of Venture Capitalism.” While a professor at Harvard Business School in 1946, he founded American Research and Development to invest in businesses run by soldiers who were returning from World War II. Over time, the industry migrated to the West Coast where it played a principal role in nurturing the semiconductor and other technology-related verticals that formed the backbone of the industry.

The Venture Capital industry has long been known for backing disruptive technologies that challenge traditional business models and seek to upend the status quo. As a consequence of the lofty aspirations of these companies, the VC ecosystem has produced incredible growth stories while also delivering a material rate of company failures. Over time, there have been numerous examples of businesses being launched from garages that have gone on to achieve global impact and recognition. Heard of this one?

One of the more well-known VC examples is Google (now Alphabet), a story in which Sergey Brin and Larry Page met at Stanford in 1995 and began work on their search engine from Page's garage. They incorporated Google in 1998 and moved into a small office in Menlo Park from which the company has now grown into a $1.5T market cap due to its Search, YouTube, advertising and related businesses. The rest is history you can easily research by going to Google, of course.

Private Equity Industry Breakdown and Size of Segments

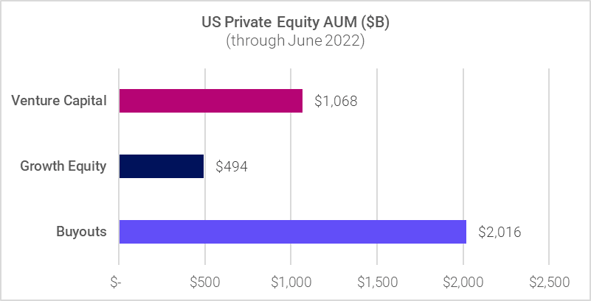

Venture Capital is an element of Private Equity, which also includes Buyouts (representing the most mature businesses) and Growth Equity (which sits between Buyouts and VC on the business maturity spectrum).

Let’s define these:

- Venture Capital: Minority investments in startups, which typically have unproven business models that may not yet generate revenue or profits. Funds invest in many businesses and rely on a small number of major successes to make up for high failure rates.

- Growth Equity: Minority investments in companies that are more mature than a startup, but less established and faster growing than a typical buyout target, and need capital to grow, commercialize or professionalize.

- Buyout: Traditionally these are majority investments in mature companies and involve restructuring the company’s finances, governance, operations or some combination of those factors to maximize returns for the fund’s investors.

Source: Preqin

Combined, the US Private Equity industry represents $3.6T in total assets as of the end 2022.

VC Growth

The VC industry grew at roughly 20% per year for the last decade through 2022 based on AUM, with similar growth in the number of investment firms entering the industry at the same time. What was once largely the domain of the connected HNW investors and endowments and foundations, has attracted institutions that now dominate the landscape. In addition, crossover investors (generally hedge funds that invest in both public and private companies) and specific mutual fund companies have become more active in venture investing.

A Breakdown of Venture Capital

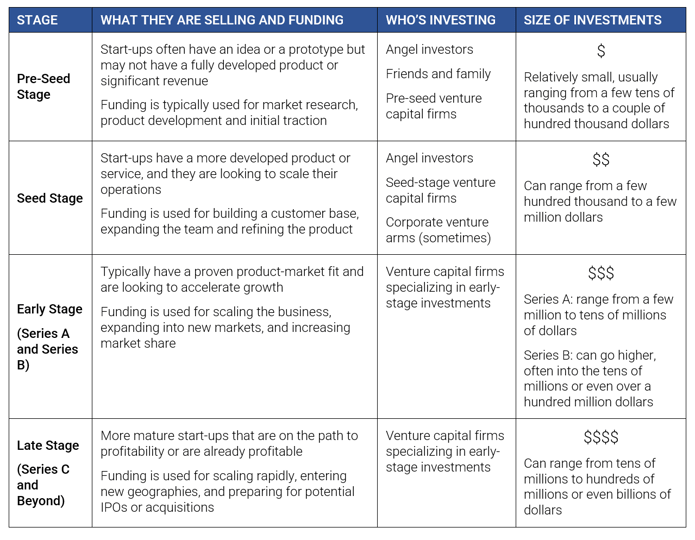

The VC market can be broken down into several sub-segments, driven by the maturity of the business and fundraising rounds, which also differ by level of risk and return attributes. Venture Capital funds tend to specialize in different segments of the market and bring specific expertise to helping their portfolio companies at different points of the lifecycle.

In addition, we can think of the level of risk associated with each stage generally decreasing as companies grow toward generating cash flow and becoming profitable businesses with attractive growth prospects.

Venture Capital Funding Stages

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

IMPORTANT RISK DISCLOSURE

Mutual funds involve risk including possible loss of principal. There is no assurance that the Fund will achieve its investment objective. Diversification does not ensure profits or prevent losses.

Mutual funds involve risks including the possible loss of principal. The Fund may invest in ETFs, ETNs and mutual funds, which are subject to investment advisory and other expenses, which will be indirectly paid by the Fund. ETFs, ETNs and mutual funds are subject to issuer, fixed income and risks specific to the Fund. The Fund does not invest in venture capital funds nor does it invest directly in the company funded by venture capital funds. The Fund seeks to generate returns that mimic the aggregate returns of U.S. venture capital backed companies as measured by the FTSE Venture Capital Index (TRVCI). There is a risk that Funds’ return many not match or achieve a higher degree of correlation with the return of the TRVCI. Additionally, the TRVCI’s return may not match or achieve a high degree of correlation with the return of the U.S. venture capital-based companies.

Investments in equity securities are subject to overall market risks. To the extent that the Fund’s investments are concentrated in or significantly exposed to a particular sector, the Fund will be susceptible to loss due to adverse occurrences affecting that sector. Loss may result from the Fund’s investments in derivatives. These instruments may be illiquid, difficult to value and leveraged so that small changes may produce disproportionate losses to the Fund. Over the counter derivatives, such as swaps, are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. In certain circumstances, it may be difficult for the Fund to purchase and sell particular derivative investments within a reasonable time at a fair price.

The AXS FTSE Venture Capital Return Tracker Fund (LDVIX) (the “Fund”) has been developed solely by AXS Investments LLC. The Fund is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies.

All rights in the FTSE Venture Capital Index (the “Index”) vest in the relevant LSE Group company which owns the Index. “FTSE®” “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®” and “The Yield Book®” are trademarks of the relevant LSE Group company and are used by any other LSE Group company under license.

The Index is calculated by or on behalf of London Stock Exchange Group plc or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the Fund. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the Fund or the suitability of the Index for the purpose to which it is being put AXS Investments LLC.

Distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments. AXI000431

Author: AXS Investments

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

The AXS FTSE Venture Capital Return Tracker Fund does not invest in venture capital funds or start-u...

The AXS FTSE Venture Capital Return Tracker Fund does not invest in venture capital funds or start-u...

If entrepreneurs are the rock stars of the business world, venture capitalists are the promoters who...