The Long-Term Inflation Game: Why Equity ETFs May Be a Winning Play

Inflation appears to be easing from the lofty 9.2% annualized spike of 2022. But even a 3% to 4% inflation rate still erodes the purchasing power of your savings and undermines long-term investment success. Resilient portfolios require effective inflation hedges for optimal results.

Fortunately, there are a variety of investment options when constructing an inflation-sensitive portfolio. The stock market, with its high long-term return potential, is one of those options, despite the threat of short-term volatility. Moreover, equity ETFs (Exchange Traded Funds) offer multiple avenues to access inflation-sensitive stocks in a user-friendly, low-cost wrapper.

Equities have historically demonstrated their ability to outperform inflation over the long term. In this AXS blog, we will explore the role of stocks as an inflation hedge, and which sectors and equity ETFs to consider when building an inflation-sensitive portfolio. Additionally, we’ll explore the benefits of considering international stocks in inflationary times.

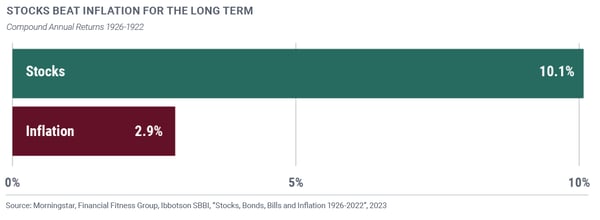

Long-Term Outperformance of Equities vs. Inflation

Historically, U.S. equities have outperformed inflation over extended periods. Despite short-term fluctuations, the stock market’s overall trajectory has surpassed the inflation rate, making stocks an attractive asset class for investors.

Examining shorter time periods, equities have been most likely to outperform when inflation is below 3%, according to one study. During periods of high inflation, stocks outperformed inflation approximately half of the time—a coin toss.1

Understanding the Potential of Stocks as an Inflation Hedge

Certain companies have the potential to exhibit resilience during inflationary environments. As businesses adjust their prices to keep pace with rising costs, corporate earnings can increase depending on the nature of the business, leading to potential stock price appreciation. Stocks can serve as an inflation hedge for multiple reasons:

- Earnings Growth Potential: Inflation can lead to increased prices, which may boost a company’s revenues and profits. Certain sectors, such as energy, materials and healthcare, benefit directly from rising prices, contributing to potential earnings growth.

- Real Assets and Tangible Value: Stocks represent ownership in real companies with tangible assets and value. As the value of these assets rises with inflation, the underlying stocks can reflect this appreciation.

- Corporate Responsiveness and Flexibility: By owning stocks, investors are shareholders in companies that can respond to inflationary pressures by adjusting their business strategies and operations. This flexibility can lead to increased resilience during inflationary periods for certain industries and firms.

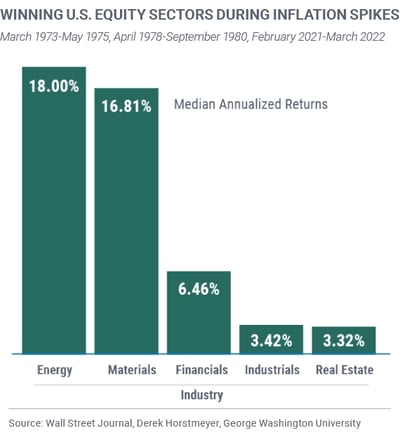

Which Sectors Can Outperform During Inflation?

Certain equity sectors have demonstrated the ability to outperform during inflationary environments.2 These inflation-resilient sectors can provide potential opportunities for investors.

- Energy and Materials: Companies operating in the energy and materials sectors tend to benefit from higher prices during inflationary periods.

- Rising Rate Beneficiaries: Inflation can spur interest rate hikes. Industries such as financials may benefit from rising rates during inflation, which can positively impact their earnings.

- Businesses with Pricing Power: Companies with the ability to adjust prices in response to inflation can protect their profit margins.

- Quality and Value: High-quality and value-oriented companies, with strong financial positions and steady cash flows, are often well-positioned to weather inflationary pressures. Furthermore, current earnings, which drive valuations for value stocks, become more valuable in a high inflation environment.

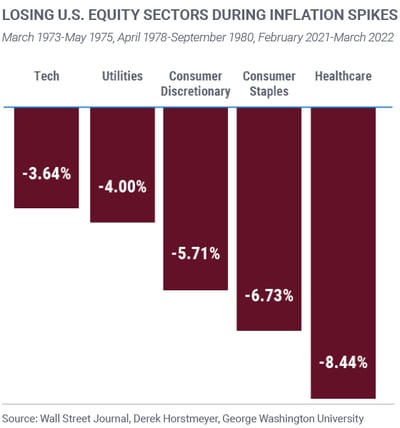

Which Sectors May Suffer During Inflation?

While certain sectors may prosper during inflation, many others may face challenges.3 It’s essential to be aware of stocks that may be vulnerable during inflationary periods.

- Consumer-Related: Consumer-related businesses might experience a decline in demand as consumers taper their spending in response to rising prices, and may face a decline in profits as production costs rise. However, some consumer-related companies are able to increase prices and pass on higher expenses.

- Businesses Without Pricing Flexibility: Companies that lack the ability to pass on increased costs to customers may experience margin pressures.

- Technology: The technology sector, especially growth-oriented stocks, may face headwinds during inflation, since future earnings become less valuable. Technology stocks endured a significant decline in the “spikeflation” episode of 2022.

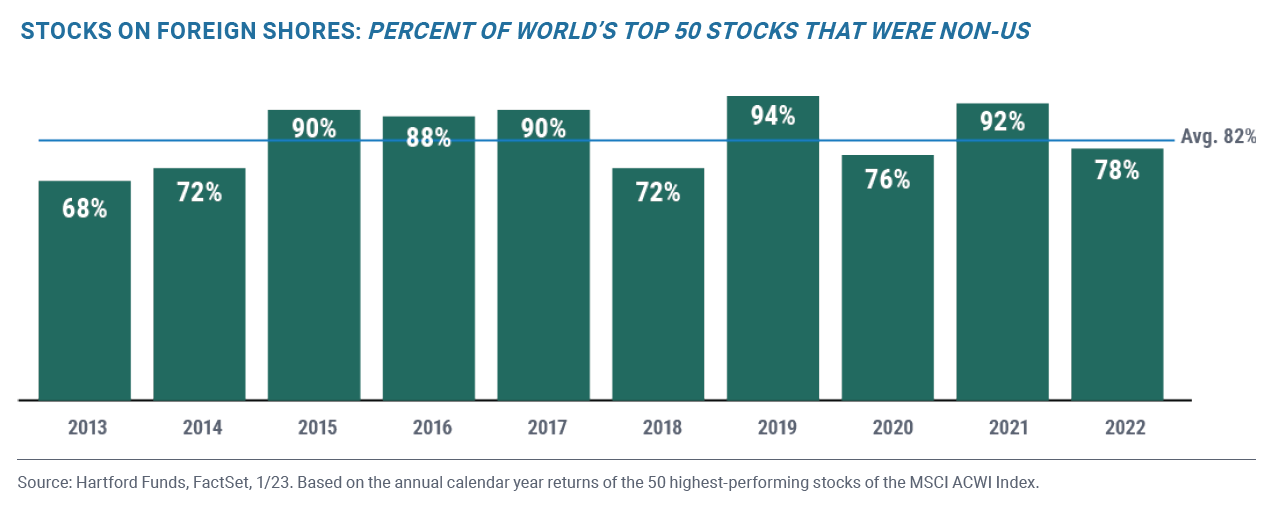

International Stocks & Inflation

International stocks may help hedge against inflation risks for multiple reasons:

- Diversification: International markets may experience different economic conditions than the U.S., offering potential diversification benefits. Remember that diversification cannot ensure a profit or protect against loss.

- Sector Tilt: International equity markets and indices have greater weights in sectors that historically outperform during inflation, such as financials, energy and materials.4

- Value Tilt: International equity indices have a greater value-style tilt than U.S. markets. Current earnings, which drive valuations for value stocks, can be perceived as more valuable than future earnings amidst high inflation.5

Over the decades, U.S. and international stocks have traded places as performance leaders. The U.S. has led for a number of years now. Contrarians say that the time is ripe for a leadership reversal. Despite recent U.S. dominance, the top-performing stocks in any calendar year are more likely to be found on foreign shores.

Equities for Inflation

Stocks have the potential to serve as an effective inflation hedge due to their earnings growth potential, ownership in real assets, and historical performance during some inflationary periods. When included as part of a well-structured inflation-sensitive portfolio, stocks may contribute to overall resilience and growth potential.

Build an Inflation-Sensitive Portfolio with ETFs

Understanding inflation is the first step. Building an inflation-resilient portfolio is your next step. Fortunately, the universe of user-friendly, tax-efficient, and low-cost ETFs offers a wide variety of choices for inflation-sensitive investors.

1. Duncan Lamont, CFA, “Which Equity Sectors Can Combat Higher Inflation?” Hartford Funds, 2023.

2. Derek Horstmeyer, George Washington University, “Which Stocks Do Best During High Inflation? A look at past inflationary periods offers clues on where to invest,” Wall Street Journal, June 5, 2022.

3. Horstmeyer, “Which Stocks Do Best”

4. Jared Leonard, “A Whole New World? Why International Stocks May Finally Shine,” Hartford Funds, 2023.

5. Leonard, “Whole New World”

----

As with any investment, individual risk tolerance, time horizon and long-term investment objectives should guide the allocation decisions. By thoughtfully incorporating ETFs with inflation-hedging potential, investors may be able to bolster their portfolios and position themselves to navigate inflation’s challenges.

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

Investors should carefully consider the investment objectives, risks, charges and expenses of AXS Astoria Inflation Sensitive ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by visiting www.axsinvestments.com. The Prospectus should be read carefully before investing.

Distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments. AXI000301

Author: John Davi

Portfolio Manager, AXS Astoria Inflation Sensitive ETF (PPI) Mr. Davi is the CEO, CIO and Founder of Astoria Portfolio Advisors, a leading investment management firm and ETF Strategist, specializing in research driven, multi-asset ETF and thematic equity portfolio construction. He is an award-winning research strategist and has over 20 years of experience as an ETF industry leader and innovator.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

By the time inflation reemerged from a three-decade hibernation, Astoria Portfolio Advisors and CEO ...

Today we face a challenge that lay dormant for years. Inflation rose rapidly in 2021 driven by pande...

Inflation has been a top financial headline for a while due to its pervasive impact on consumers, bu...

-1.png?width=757&height=226&name=30212%20%20AXS%20Schedule%20a%20Consultation%20Promotional%20Email%20Campaign%20v1%20(5)-1.png)