How TIPS ETFs Might Help You Stay Ahead of Inflation

In 1997, the U.S. Treasury introduced a new inflation hedge for investors: Treasury Inflation-Protected Securities (TIPS). According to the U.S. Treasury, it has issued over $1.5 trillion of TIPS outstanding as of June 30, 2023.

What’s the appeal of TIPS? How do ETFs give investors a user-friendly way to access TIPS?

In this article, we will explore the many facets of TIPS, a popular tool to counter against inflation. We’ll cover the basics of TIPS, their history, mechanics and risks, as well as compare them to nominal bonds and discuss the Breakeven Inflation Rate.

We’ll also delve into the most effective TIPS for inflation hedging and highlight some TIPS ETFs worth considering.

The Basics of TIPS

1. What are TIPS?

TIPS are U.S. Treasury securities designed to protect investors from inflation. Unlike conventional bonds, the principal value of TIPS adjusts with changes in inflation. As inflation rises, the principal value increases, boosting income and providing investors with higher returns.

2. History of TIPS

TIPS were introduced by the U.S. Treasury in 1997 to address inflation concerns and provide a reliable inflation hedge for investors. Since then, they have become a popular choice among investors seeking protection against the erosion of purchasing power caused by inflation.

3. Mechanics of TIPS & CPI-U

TIPS are issued with a fixed coupon rate, and their principal value adjusts based on changes in inflation. This means that the interest payments or coupons increase with inflation, while the principal value rises (or falls) to maintain the purchasing power of the investment. The U.S. Treasury selected a specific version of the Consumer Price Index to calculate the inflation adjustment for TIPS: the CPI-U, or Urban Consumer CPI, the “non-seasonally adjusted U.S. City Average All Items Consumer Price Index for All Urban Consumers.” The CPI-U is published by the U.S. Bureau of Labor Statistics.

10-Year TIPS: Hypothetical Illustration1

The table below provides a hypothetical illustration of the growth of principal and interest payments for a TIPS security based on a 1% coupon rate and a constant 3% inflation rate.

Source: Schwab Center for Financial Research. The annual coupon payment equals the fixed coupon rate multiplied by the adjusted principal value. For this illustration, the initial TIPS principal value is $1,000. Note that TIPS coupon payments are paid semiannually, not annually as illustrated. Past performance is no guarantee of future results. Hypothetical, for illustration only.

Source: Schwab Center for Financial Research. The annual coupon payment equals the fixed coupon rate multiplied by the adjusted principal value. For this illustration, the initial TIPS principal value is $1,000. Note that TIPS coupon payments are paid semiannually, not annually as illustrated. Past performance is no guarantee of future results. Hypothetical, for illustration only.

4. TIPS vs. Nominal Bonds & the Breakeven Inflation Rate

Nominal bonds offer a fixed interest rate, making them susceptible to the erosive effects of inflation over time. The Breakeven Inflation Rate represents the difference between the yield on TIPS and the yield on nominal bonds of the same maturity.

10-Year U.S. Treasury Yields versus TIPS Yields2

Source: Federal Reserve Board, Yardeni.com. Past performance is no guarantee of future results.

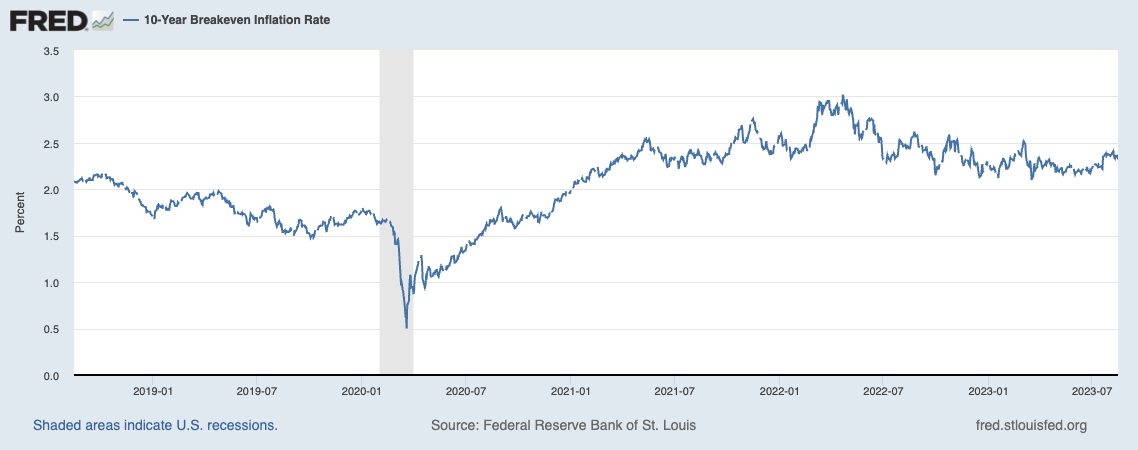

The Breakeven Inflation Rate provides an indication of the market’s evolving inflation expectations over time. Long-term inflation expectations fell in 2020 during the pandemic but rose in 2022 when inflation spiked.

TIPS 10-Year Breakeven Inflation Rate3

Past performance is no guarantee of future results.

5. Risk of TIPS

Although TIPS offer inflation protection, they are not without risks. One of the primary risks is interest rate risk, which can impact the prices of TIPS in a rising interest rate environment. Duration risk is a significant issue with TIPS, like any other bond. Additionally, changes in CPI-U calculations or unexpected deflation can also affect TIPS returns.

Which TIPS Are Most Effective for Inflation Hedging?

1. Long-Duration TIPS & Bond Market Volatility: Long-duration TIPS, with maturities of 10 years or more, provide enduring inflation protection due to their extended time horizon. However, they are also more sensitive to changes in interest rates, making them susceptible to bond market volatility.

2. Short-Duration TIPS & Inflation Sensitivity: Short-duration TIPS, with maturities of five years or less, offer less interest rate risk compared to long-duration TIPS. They are more responsive to changes in inflation expectations, making them attractive for investors seeking inflation protection without taking on significant interest rate or duration risk.

TIPS: A Mainstay for Inflation-Sensitive Investors

Treasury Inflation-Protected Securities serve as a valuable tool for investors seeking to hedge against inflation and preserve their purchasing power. Understanding the mechanics and risks of TIPS, as well as comparing them to nominal bonds, can help investors make informed decisions.

Depending on risk tolerance and investment goals, investors can choose between long- and short-duration TIPS as they construct an inflation-sensitive portfolio. For those looking for the benefits of TIPS in a convenient and diversified manner, TIPS ETFs can offer a compelling solution to navigate inflationary environments.

Build an Inflation-Sensitive Portfolio With ETFs

Understanding inflation and inflation-sensitive investments is a good start. Building an inflation-sensitive portfolio is your next step. Fortunately, the universe of user-friendly, tax-efficient and low-cost ETFs offers a wide variety of choices for investors.

1. Charles Schwab, “Treasury Inflation-Protected Securities: FAQs about TIPS,” December 6, 2021.

2. Dr. Edward Yardeni et al., “Market Briefing: Nominal & Real Yields & Inflationary Expectations,” Yardeni Research, Inc., August 16, 2023.

3. Economic Research, Federal Reserve Bank of St. Louis, “10-Year Breakeven Inflation Rate,” FRED Economic Data, retrieved August 16, 2023.

As with any investment, individual risk tolerance, time horizon and long-term investment objectives should guide the allocation decisions. By thoughtfully incorporating ETFs with inflation-hedging potential, investors may be able to bolster their portfolios and position themselves to navigate inflationary environments. ETFs involve risk including possible loss of principal. Diversification is a strategy designed to manage risk. It cannot ensure a profit or protect against loss in a declining market.

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

IMPORTANT RISK DISCLOSURE ABOUT THE AXS ASTORIA INFLATION SENSITIVE FUND (TICKER: PPI)

ETFs involve risk including possible loss of principal. There is no assurance that the Fund will achieve its investment objective.

There is no guarantee the sectors or asset classes the advisor identifies will benefit from inflation. Fund may invest a larger portion of its assets in one or more sectors than many other funds, and thus will be more susceptible to negative events affecting those sectors.

Equity Securities Risk: Equity securities may be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase. Equity securities may decline significantly in price over short or extended periods of time, and such declines may occur in the equity market as a whole, or in only a particular country, company, industry or sector of the market.

Commodities Risk: Commodity prices can have significant volatility, and exposure to commodities can cause the value of the Fund’s shares to decline or fluctuate in a rapid and unpredictable manner. The values of commodities may be affected by changes in overall market movements, real or perceived inflationary trends, commodity index volatility, changes in interest rates or currency exchange rates, population growth and changing demographics, international economic, political and regulatory developments, and factors affecting a particular region, industry or commodity.

Futures Contracts Risk: The Fund expects that certain of the Underlying ETFs in which it invests will utilize futures contracts for its commodities investments. The risk of a position in a futures contract may be very large compared to the relatively low level of margin the underlying ETF is required to deposit. In many cases, a relatively small price movement in a futures contract may result in immediate and substantial loss or gain to the investor relative to the size of a required margin deposit. The prices of futures contracts may not correlate perfectly with movements in the securities or index underlying them.

TIPS Risk: Principal payments for Treasury Inflation-Protection Securities are adjusted according to changes in the Consumer Price Index (CPI). While this may provide a hedge against inflation, the returns may be relatively lower than those of other securities. Similar to other issuers, changes to the financial condition or credit rating of the U.S. government may cause the value of the Fund's exposure to U.S. Treasury obligations to decline.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the ETF. Brokerage commissions will reduce returns. NAVs are calculated using prices as of 4:00 PM Eastern Time. The closing price is the midpoint between the bid and ask price as of the close of exchange. Closing price returns do not represent the returns you would receive if you traded shares at other times.

Investors should carefully consider the investment objectives, risks, charges and expenses of AXS Astoria Inflation Sensitive ETF. This and other important information about the Fund is contained in the Prospectus, which can be obtained by visiting www.axsinvestments.com. The Prospectus should be read carefully before investing.

Distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments. AXI000316

Author: John Davi

Portfolio Manager, AXS Astoria Inflation Sensitive ETF (PPI) Mr. Davi is the CEO, CIO and Founder of Astoria Portfolio Advisors, a leading investment management firm and ETF Strategist, specializing in research driven, multi-asset ETF and thematic equity portfolio construction. He is an award-winning research strategist and has over 20 years of experience as an ETF industry leader and innovator.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

By the time inflation reemerged from a three-decade hibernation, Astoria Portfolio Advisors and CEO ...

Today we face a challenge that lay dormant for years. Inflation rose rapidly in 2021 driven by pande...

Inflation has been a top financial headline for a while due to its pervasive impact on consumers, bu...

-1.png?width=757&height=226&name=30212%20%20AXS%20Schedule%20a%20Consultation%20Promotional%20Email%20Campaign%20v1%20(5)-1.png)