Commodity ETFs as an Inflation Hedge

Inflation can erode the purchasing power of your investments over time, making it essential for you to hedge your portfolio against its effects. One effective way to offset inflation is by incorporating commodities into an investment strategy.

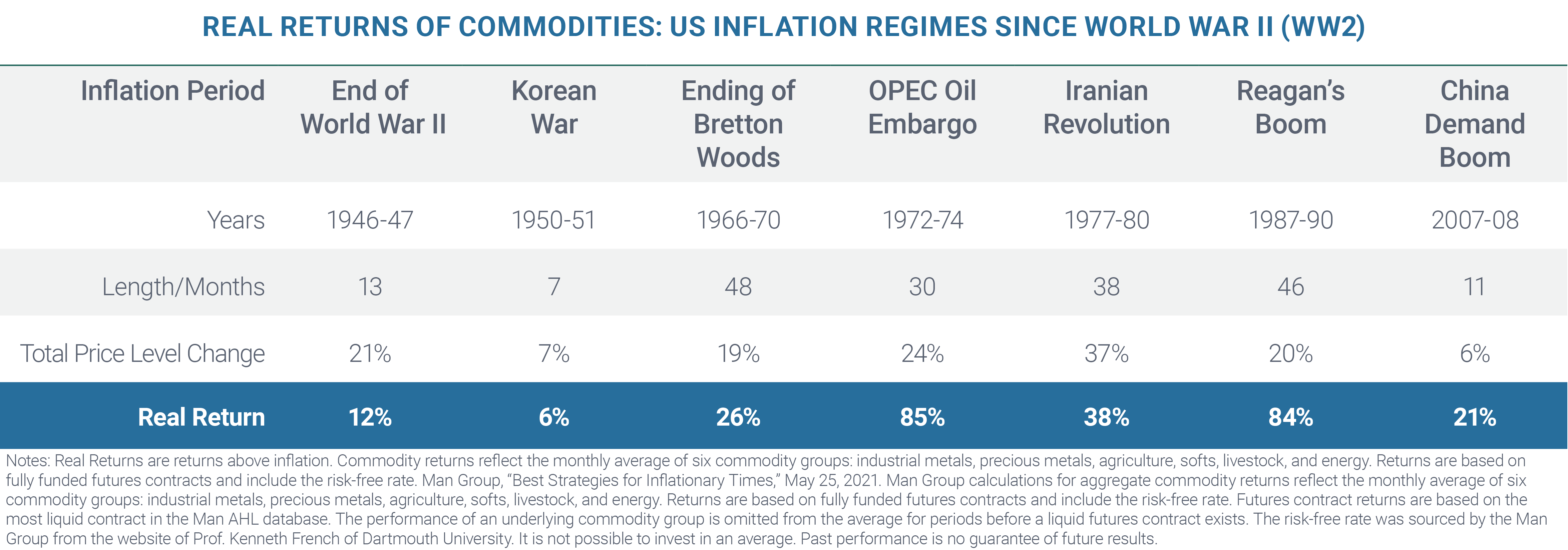

In fact, one team of researchers found that commodities generated positive real returns in all major U.S. inflationary episodes since 1926 (although results can vary by commodity and returns were muted in non-inflationary periods).1

In this AXS blog, we will explore the link between commodities and inflation, understand how commodities act as a hedge, analyze the performance of various commodity types during inflationary periods, and examine different commodity ETF structures for building an inflation-sensitive portfolio.

The Link Between Physical Commodities & Inflation

Commodities, which include natural resources such as energy, metals and agricultural products, have historically shown a strong relationship with inflation. As inflation rises, the prices of goods and services increase, driving up the costs of production and distribution. This, in turn, leads to higher prices for raw materials and commodities. Sometimes, the commodity itself is rising in price and driving inflation. In response, investors may turn to commodities during inflationary periods to preserve their wealth and maintain purchasing power.

Commodity Returns in Inflationary Times

How Commodities Can Act as a Hedge

Commodities offer several attributes that make them attractive as an inflation hedge:

- Intrinsic Value: Unlike financial assets, commodities possess tangible value due to their use in the production of goods and services, which supports their prices during inflationary times.

- Diversification: Adding commodities to a portfolio can help reduce overall risk because they often have a low correlation with traditional assets like stocks and bonds. This means that when inflation impacts financial markets, commodities may behave differently, potentially offsetting losses in other areas of the portfolio. As noted above, commodities have historically outperformed during inflation spikes. Keep in mind that while diversification is a strategy designed to mitigate risk, it does not ensure a profit or protect against loss.

- Limited Supply: Many commodities have finite supply levels, which means that increased demand can lead to supply shortages and higher prices.

- Global Demand: As economies grow, the demand for commodities tends to rise, especially in emerging markets. This increased demand can further support commodity prices during inflationary periods. (Note, however, that rising prices may increase supply and subsequently reduce commodity prices. Moreover, improved extraction technology can drive down prices.)

Overview of Commodity Types & Their Historical Performance in Inflationary Periods

Various commodity types have demonstrated differing degrees of sensitivity to inflation. Understanding their historical performance can aid in constructing an inflation-sensitive portfolio. Here are some key commodity types and their characteristics:

- Energy: Energy commodities, such as crude oil and natural gas, are highly influenced by inflation or can even drive inflation due to their critical role in powering economies and transportation. We saw this occur in 1973 and 2008.

- Precious Metals: Precious metals, like gold and silver, have long been considered refuge assets during times of inflation and economic uncertainty. Their limited supply and status as stores of value can lead to increased demand during inflationary environments, driving up their prices.

- Industrial Metals: Industrial metals, such as copper and aluminum, have a strong correlation with economic growth. As industries expand, the demand for industrial metals increases, causing inflationary price increases.

- “Ags” & “Softs”: The “Ags” category encompasses agricultural commodities like corn, soybeans and wheat. “Softs” include products like coffee, cocoa and cotton. These commodities tend to respond positively to inflation, as higher prices for agricultural products are often passed on to consumers.

Commodity ETF Structures

When considering commodity investments through ETFs, investors have access to multiple structures. Since these structures are varied, some prefer to call them exchange traded products or ETPs. While some commodity ETPs may hold physical stockpiles, most gain exposure through futures or derivatives. ETPs holding physical assets are a smaller part of the commodity ETP population, and are limited primarily to precious metals, due to storage challenges for other types of commodities. Precious metals commodities are typically structured as trusts.

Investors in futures-based commodity ETFs must be aware of the differences between spot and futures prices for a given commodity, as those differences can contribute significantly to risks and tracking error, as well as profit opportunities. Some futures-based commodity ETFs seek to profit from the roll yield that may result when “rolling” near-term spot futures to longer-term contracts (although the roll yield may also be negative).

Physical Commodities, Commodities Futures & Commodities ETPs

Commodities are integral to economic activity. Participants in the commodities markets encompass 4 broad groups:

- Businesses & manufacturers that rely on essential materials for their business

- Producers such as miners & farmers

- Speculators seeking a profit

- Investors seeking longer-term exposure to commodities or to hedge against inflation

Investors may implement their commodity investing through physical commodities, commodities futures, or Exchange Traded Products (ETPs). ETPs offer convenient and cost-effective access to both.

Physical Commodities

Physical commodities are the real thing, such as a bar of gold. Industries often have specific delivery guidelines for physical commodities. The standard gold bar held by central banks and traded among bullion dealers is 400 troy ounces, equal to 438.86 regular or “avoirdupois” ounces, 27.43 pounds or 12.44 kilograms. A 1-troy-ounce bar of gold is popular among collectors but may cost 2% to 10% to buy or sell.

A consumer may be able to buy a pound of pork in a small package at the local grocery. In contrast, a Lean Hog futures contract on the Chicago Mercantile Exchange represents 40,000 pounds of meat. Such commodities are easier to trade as a futures contract.

Commodities Futures

According to the U.S. Commodities Futures Trading Commission (CFTC), “A commodity futures contract is an agreement to buy or sell a particular commodity at a future date. The price and the amount of the commodity are fixed at the time of the agreement.”Most futures contracts contemplate that the agreement will be fulfilled by the actual delivery of the commodity. Nevertheless, some contracts allow cash settlement in lieu of delivery and most contracts are liquidated before the delivery date.

With limited exceptions, commodity futures must be traded through an exchange by persons and firms who are registered with the CFTC.

Commodity ETPs

Commodity ETPs offer an efficient way to invest in or trade commodities with the simplicity of trading a stock—without the complexities and costs of moving or storing physical commodities, and without the complexities, margin requirements or risks of futures contracts.

Commodities: A Long History as an Inflation Hedge

Commodities have historically served as an effective hedge against inflation, offering intrinsic value, diversification benefits and limited supply during inflationary periods.

Investors seeking to build an inflation-sensitive portfolio can consider different commodity types and ETP structures to enhance their exposure to this asset class. Investors must understand the idiosyncrasies of their commodity-related investments as well as the underlying instruments and delivery structures.

The sizing of a commodity allocation requires careful consideration. While commodities may profit during an inflation spike, returns for some commodities may lag in other periods. Investors must carefully consider the impact of a commodities allocation on an overall portfolio across varying market cycles.

Careful selection and diversification within the commodity segment can potentially help investors preserve purchasing power during inflationary times.

Build an Inflation-Sensitive Portfolio with ETFs

Understanding inflation is a fine place to start; building a portfolio with inflation-sensitive investments is your next step. Fortunately, the universe of user-friendly, tax-efficient and low-cost ETFs offers a wide variety of choices for inflation-sensitive investors.

1 Henry Neville et al., “The Best Strategies for Inflationary Times,” Man Group, May 25, 2021, pages 1, 4, 13-15.

As with any investment, individual risk tolerance, time horizon and long-term investment objectives should guide the allocation decisions. By thoughtfully incorporating ETFs with inflation-hedging potential, investors may be able to bolster their portfolios and position themselves to navigate inflationary environments.

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

ETFs involve risk including possible loss of principal. Diversification is a strategy designed to manage risk. It cannot ensure a profit or protect against loss in a declining market.

Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors. The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and may be affected by changes in overall market movements, volatility of the index, changes in interest rates, or factors affecting a particular industry or commodity, such as global pandemics, weather and other natural disasters, changes in supply and production, embargoes, tariffs and international economic, political and regulatory developments and changes in speculators’ and/or investors’ demand. Commodity-linked derivatives also may be subject to credit and interest rate risks that in general affect the value of debt securities. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other investments.

Risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the futures contract; (b) possible lack of a liquid secondary market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Index’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities or financial instruments from its portfolio to meet daily variation margin requirements, which may lead to the Fund selling securities or financial instruments at a time when it may be disadvantageous to do so.

AXI000314

Author: John Davi

Portfolio Manager, AXS Astoria Inflation Sensitive ETF (PPI) Mr. Davi is the CEO, CIO and Founder of Astoria Portfolio Advisors, a leading investment management firm and ETF Strategist, specializing in research driven, multi-asset ETF and thematic equity portfolio construction. He is an award-winning research strategist and has over 20 years of experience as an ETF industry leader and innovator.

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

By the time inflation reemerged from a three-decade hibernation, Astoria Portfolio Advisors and CEO ...

Today we face a challenge that lay dormant for years. Inflation rose rapidly in 2021 driven by pande...

Inflation has been a top financial headline for a while due to its pervasive impact on consumers, bu...

-1.png?width=757&height=226&name=30212%20%20AXS%20Schedule%20a%20Consultation%20Promotional%20Email%20Campaign%20v1%20(3)-1.png)