Spikeflation or Persistent Inflation: Time To Restructure Your Portfolio?

When investing, risk is ever-present but in different forms. Sometimes it’s volatility, other times a bear market, and other times a recession.

Today, inflation has reasserted itself as a key risk and concern for investors. While future inflation is uncertain, the fact that we’re debating the topic means we must pay attention.

How can you seek to restructure your investments from inflation? Or even benefit from inflation?

In this AXS blog, we’ll explore the nature of inflation and the two key types of inflation every investor must understand. Then, we’ll introduce time-tested approaches to potentially enhance your portfolio with user-friendly, cost-effective and tax-efficient ETFs for inflationary times.

What is Inflation?

Inflation is the persistent increase in the general price level of goods and services in the economy. As prices rise, the purchasing power of your money declines. You need more money to buy the same goods and services. Your money buys fewer goods and services than before. Our experience at the gas pump is illustrative. In 1989, a gallon of gasoline cost $1. Today, it costs more than $4.1

Inflation silently erodes the value of hard-earned cash and capital, income, and savings. Due to its corrosive effects, inflation can provoke a keen response. One American president even called inflation “public enemy number one” in a historic speech before Congress.2

“Inflation silently erodes the value of hard-earned cash and capital, income and savings.”

As an advisor or investor, it’s crucial to understand inflation and its implications.

Inflation: A Problem for Investors

Inflation presents a significant challenge for investors because it erodes the real value of their investments. When the rate of return on investments fails to outpace the inflation rate, the purchasing power of the investment declines over time. Investors may find that what seemed like a sizable nest egg years ago may not be adequate to maintain their standard of living in the face of rising prices.

Investment returns must outpace inflation to achieve real growth. When inflation accelerates, investors require higher returns just to maintain their purchasing power, which may be difficult to achieve. Without real returns, inflation undermines the value of investor savings and future income.

Two Key Types of Inflation

It’s crucial to understand inflation and its implications. You must understand the different challenges posed by the two key types of inflation:

Let’s explore how these inflationary forces can negatively impact your portfolio and discuss the need for inflation protection to achieve long-term investment success.

1. Short Term: Inflation Shocks & Surprises — "Spikeflation"

Short-term inflation shocks, also known as “spikeflation,” refer to sudden and unexpected increases in inflation that catch investors and economies off guard. These spikes can create uncertainty, financial market volatility and economic dislocation. Catalysts include supply chain disruptions, geopolitical events or other unforeseen factors. These sudden increases may also trigger a sharp drop in financial asset values as investors adjust their expectations.

“Spikeflation refers to a sudden and unexpected increase in inflation that catches investors and economies off guard.”

“Spikeflation” can also negatively impact economic activity, disrupting consumer and business activity and investment, typically compelling policymakers and government to intervene. Interventions may include raising interest rates in an effort to tame inflation, which can cause further economic dislocation.

Including inflation-sensitive assets in a portfolio may serve as a hedge against future “spikeflation.” A diversified approach is prudent, as the responsiveness and effectiveness of inflation hedges will vary across time periods.

“Spikeflation” and Financial Market Declines

Over the past 50 years, the U.S. witnessed a number of inflation spikes3 despite a downtrend in inflation from 1982 to 2020. Financial market declines accompanied many of these spikes.

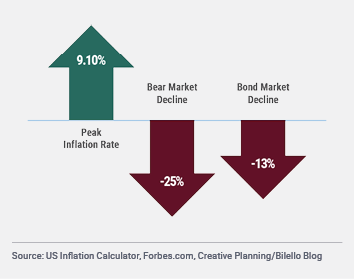

2022: Post-COVID

In 2022, the U.S. witnessed a peak inflation rate of 9.2%, the highest level in over 40 years. The inflation spike was driven by pandemic-related dynamics, from supply chain disruptions to fiscal and monetary stimulus by governments worldwide to stop a COVID-driven recession—the result: a double-digit decline for stocks and bonds.

Source: US Inflation Calculator, Forbes.com, Creative Planning/Bilello Blog

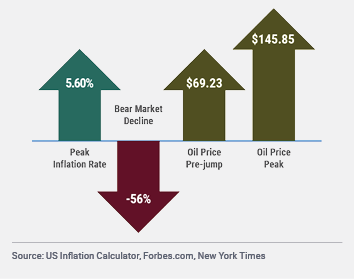

2008: Oil Price Skyrockets

In 2008, the CPI rose above 5% for two months due to skyrocketing gas prices. The price of a barrel of oil doubled from $70 to over $145 compared to a year earlier. This inflation spike may have contributed to the equity market decline of the Great Financial Crisis. The ensuing recession reversed the energy price rise.

Source: US Inflation Calculator, Forbes.com, New York Times

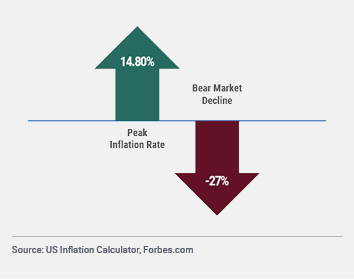

1980 to 1982: The Battle Against the Great Inflation

Persistent inflation was the dominant force in the U.S. economy from 1965 to 1982. Shortly after Paul Volker became Chairman of the U.S. Federal Reserve in 1979, year-over-year inflation peaked at 14.8% in1980. U.S. equities fell 27% as Volker raised rates repeatedly to fight double-digit inflation. A recession and bear market ensued. The Dow Jones Industrial Average posted a low of 776.92 in August 1982. A long period of sustained growth and subdued inflation followed.

Source: US Inflation Calculator, Forbes.com

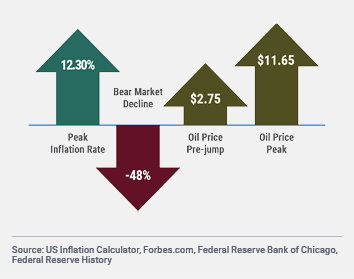

1973 to 1974: OPEC Oil Embargo

With the first OPEC oil embargo, the price of oil quadrupled at the end of 1973, and inflation nearly doubled from 6% in 1973 to 11% in 1974. A dollar currency crisis precipitated by the end of the gold standard and political turmoil were additional inflation drivers. A bear market in equities spread worldwide and the Dow Jones Industrial Average fell 45%. Another oil price shock followed in 1978 and 1979.

Source: US Inflation Calculator, Forbes.com, Federal Reserve Bank of Chicago, Federal Reserve History

2. Long Term: Persistent Inflation

With long-term persistent inflation, inflation isn’t a surprise, it’s an ongoing phenomenon, persistently eroding purchasing power. Money saved today becomes less valuable tomorrow.

Persistent inflation, a sustained increase in inflation over an extended period, can be driven by various factors. Drivers include lax monetary policy and excessive money supply growth, as well as sustained fiscal stimulus. Raw material shortages can elevate commodity prices. Labor costs can steadily rise, as workers seek higher wages to meet future price increases. Structural changes in consumer demand and supply dynamics can further fuel inflation.

Even the expectation of inflation can drive inflation!

Contributing factors to persistent inflation are many, which is why inflation can become entrenched and resistant to policymakers’ attempts at relief.

Persistent inflation steadily erodes the value of money. While less shocking than “spikeflation,” this type of inflation can have a profound impact on investment portfolios, especially for retirees or any other investor with a long time horizon.

“Persistent inflation steadily erodes the value of money.”

Persistent inflation may make certain asset classes less or more attractive. For example, conventional fixed-income securities may suffer, as inflation decreases the purchasing power of future cash flows. In contrast, real assets may benefit, as investments like commodities may increase in value.

Persistent Inflation and the Erosion of Purchasing Power

Build an Inflation-Sensitive Portfolio With ETFs

Understanding inflation is the first step. Building an inflation-resilient portfolio is your next step. Fortunately, the universe of user-friendly, tax-efficient, and low-cost ETFs (Exchange Traded Funds) offers a wide variety of choices for inflation-sensitive investors.

1. Carly Hallman, “Gas Prices Through History,” TitleMax. https://www.titlemax.com/discovery-center/planes-trains-and-automobiles/average-gas-prices-through-history/

2. Presenting to the 93rd Congress on October 8, 1974, Gerald Ford declared inflation to be “public enemy number one.” Congress established the National Commission on Inflation.

3. Chair Cecilia Rouse, Jeffery Zhang and Ernie Tedeschi, “Historical Parallels to Today’s Inflationary Episode,” The White House Counsel of Economic Advisors, July 6, 2021. https://www.whitehouse.gov/cea/written-materials/2021/07/06/historical-parallels-to-todays-inflationary-episode/

----

As with any investment, individual risk tolerance, time horizon and long-term investment objectives should guide the allocation decisions. By thoughtfully incorporating ETFs with inflation-hedging potential, investors may be able to bolster their portfolios and position themselves to navigate inflation’s challenges.

This information is educational in nature and does not constitute investment advice. These views are subject to change at any time based on market and other conditions and no forecasts can be guaranteed. These views may not be relied upon as investment advice or as an indication of any investment or trading intent. This content should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by AXS Investments or any third-party. All investing is subject to risk, including the possible loss of the money you invest.

Distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments. AXI000299

Author: John Davi

Portfolio Manager, AXS Astoria Inflation Sensitive ETF (PPI) Mr. Davi is the CEO, CIO and Founder of Astoria Portfolio Advisors, a leading investment management firm and ETF Strategist, specializing in research driven, multi-asset ETF and thematic equity portfolio construction. He is an award-winning research strategist and has over 20 years of experience as an ETF industry leader and innovator.

Tags:

Stay Connected

Subscribe to our blog to keep up with the latest insights

Featured Posts

Related posts from blog

Check out our related posts based on your search that you may like

By the time inflation reemerged from a three-decade hibernation, Astoria Portfolio Advisors and CEO ...

Today we face a challenge that lay dormant for years. Inflation rose rapidly in 2021 driven by pande...

Inflation has been a top financial headline for a while due to its pervasive impact on consumers, bu...

-1.png?width=757&height=226&name=30212%20%20AXS%20Schedule%20a%20Consultation%20Promotional%20Email%20Campaign%20v1%20(3)-1.png)